Hydrogen may be one of the most promising sources of clean fuel for a net-zero emissions world.

it may one day completely take over heavy industry.

And those high costs of production that had it stopping and starting … well, they’re changing–fast.

Hydrogen is now racing toward an $11 trillion marketplace.

Ammonia, the newest shining star of the hydrogen game, is expected to increase in market potential to over $80 billion.

The two go hand in hand.

Together, they could completely disrupt the energy industry.

They might even outshine lithium by … megawatts.

Lithium may not be able to provide enough power to support the transition of heavy industries to clean and sustainable energy sources.

So now, with the hype fading and reality setting in, we think the hydrogen economy is primed to tip the balances in favor of attractive opportunities for investors.

With entire countries and industries investing money into hydrogen technologies,

This could become a globally traded energy source. It’s already been deemed the a “fuel of the future”, but it could be much more than that: It’s the makings of the next commodity supercycle.

We think these three companies are well positioned to give investors exposure to our fuel future:

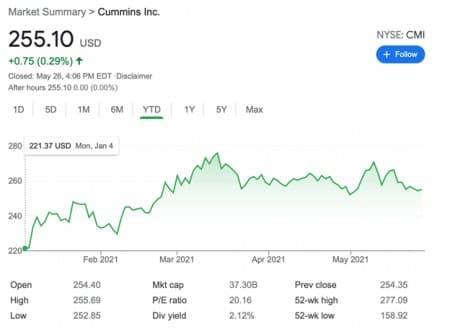

#1 Cummins Inc (NYSE:CMI)

There’s a good reason to like Cummins in this space: While PlugPower made some breathtaking returns earlier for hydrogen fuel cell investors, that boat has already left and Plug’s bubble burst along with it. But Cummins is more diverse. It’s hitting up hydrogen hard, but it’s also doing a lot of interesting things to keep diesel alive.

It’s the perfect stock for an energy transition because it’s on both sides of a divide that shouldn’t be … a divide. It’s a market transition that Cummins is navigating very well.

On one hand, the company–the largest heavy-duty engine manufacturer–is working on new technology to reduce emissions from ICE vehicles because any mandates for zero-emissions trucks are still decades away.

At the same time, Cummins is planning to build one of the world’s largest electrolyzer plants for the production of green hydrogen in Spain, in collaboration with Iberdrola. The facility will cost 50 million euros and will produce about 500 megawatts of polymer electrolyte membrane electrolyzers per year, with the potential to reach 1,000MW per year. It’s expected to be operational by 2023 already.

So, Cummins has its stake in both the present and the future, which makes its balance sheet and quarterly earnings reports more attractive to investors.

Already, Cummins has deployed more than 600 electrolyzers in 100 countries.

Year-to-date, CMI has gained about 15%.

That’s nothing compared to PlugPower’s wild gains earlier this year, most of which it’s lost since because too much of it was based on hype and too little on the balance sheet.

#2 AmmPower Corp. (CSE:AMMP; OTC:AMMPF).

AmmPower is a relatively unknown company that is hoping to rise to fame for pioneering the missing link in the hydrogen game: ammonia.

It’s got up to 9x the energy capacity of lithium-ion batteries and is 1.8X more energy-dense than liquid hydrogen.

With green ammonia, AmmPower plans to develop technology that could disrupt the industrial world and help solve our hydrogen transportation problems at the same time.

It boasts a former NASA engineer at its helm, and its scientific team has an experienced track record. AmmPower aims to develop a novel, patentable technology to produce green ammonia. Moreover, AmmPowers green technology it’s planning to develop will be econimcally competitive, 100% sustainable and scaleable.

AmmPower (CSE:AMMP; OTC:AMMPF) looks to be a first-mover in one of the fastest-paced spaces in energy. They’re aiming to revolutionize the ammonia production process and produce carbon-free ammonia.

It’s planning to build modular, scalable, stackable green ammonia-producing units that could be flexible enough to fit a wide array of customers from individual organizations, farmers, marine vessels, large marine ports, and distribution hubs.

And … it’s actively searching for a manufacturing facility in Michigan to develop optimal catalytic reactions that produce green ammonia.

In Phase I, AmmPower (CSE:AMMP; OTC:AMMPF) intends to develop 3 sizes of units to produce between 1 – 2 tons of ammonia per day.

The technology AmmPower aims to develop could allow hydrogen cracking to be done closer to the end-user, reducing point-to-point logistics costs significantly. Green ammonia is gaining ground, both for combustion as a marine fuel and as a fuel for machinery at the port systems. Ammonia can be used in ships, machinery, even railroad and airplanes.

Over 120 global ports already accept ammonia currently … and billions are being spent on new projects.

Hydrogen/ammonia tankers aren’t even futuristic. They’re already getting setto sail. This is no longer one of those energy developments that just might happen. It’s already happening.

The World Bank has already recommended avoiding LNG bunkering in favor of hydrogen and ammonia.

Argus reports that global ammonia production stands at 180mn t/yr right now, but its potential use as an energy source and energy carrier could see demand rise to a multi-billion-tonne market for use in a wide range of applications.

Indeed, according to some reports the global ammonia industry is expected to top at least $70 billion by the year 2027, or even $80 billion.

There’s a huge market looming for this, and, if it successfully develops its technology, AmmPower (CSE:AMMP; OTC:AMMPF) may pursue three massive market targets: the fertilizer Industry, the fuel Industry, and the transport sector. We expect they would start with the low-hanging fruit–selling to the fertilizer industry. Then it could target the fuel and hydrogen transport industries as those markets mature.

This all helps increase the change of success in this exciting company with a current market cap of around $70M. And timing is everything in this space …

AmmPower hopes to have its modular units in prototype form by Q4 2020, and begin selling in 2022.

And in less than 18 months, the company aims to deliver its first production units and ramp production to facility capacity. Indeed, AmmPower (CSE:AMMP; OTC:AMMPF) could target customers not only in the fertilizer space, but also in the very large shipping and maritime arenas.

For now, it’s still operating on the quiet, but with the hydrogen space beginning to heat up, we think it’s bound to start pinging Wall Street’s radar very soon.

#3 Hyundai Motors

Why Hyundai? This isn’t a hydrogen stock. But it is making a hydrogen play that we like.

And there may be a buy-on-the-dip opportunity here as the company faces a shutdown in India over COVID-19.

Hyundai is taking the hydrogen truck challenge seriously. It just announced plans to send a new series hydrogen fuel cell–Xcient–truck to Europe by Q4. The new release is billed as more efficient and have a longer lifespan.

Source: Hydrogenfuelnews.com

Hyundai’s HHM joint venture with Swiss hydrogen company H2 Energy has proved to be the most advanced project in the world on the hydrogen fuel truck scene.

Daimler, Volvo, and Iveco all have H2 projects in the planning, too, but Hyundai has gotten farther, faster.

Hyundai (and its sister company, Kia) have also just committed to investing $7.4 billion by 2025 to make EVs in the U.S. and will begin production at its Alabama facility in 2022.

Other companies set to benefit from the green energy transition:

FuelCell Energy (NASDAQ:FCEL) is another alternative fuel stock that has taken Wall Street by storm. It is an up-and-comer that has surprised even the most tuned-in investors. FuelCell is a fairly volatile stock, sometimes rising and falling as much as 10% in a single day, but it has been on a gradual climb, and momentum is likely to persist. Up nearly 261% since June 2020, many expected FuelCell to return to earth in the short term, which it has, but it still has a great long-term outlook. In fact, with the hydrogen hype growing, and Biden pushing for a multi-trillion-dollar green energy and infrastructure facelift, FuelCell and other similar companies are poised to grow by leaps and bounds in the coming years.

Sitting at just $10 at the time of writing, FuelCell is an affordable buy-in for those looking for exposure to this exciting new market. While its fundamentals may take time to mature, bullish news continues to mount for the industry as a whole, and FuelCell is well-positioned to take advantage of an influx of funds flowing into the sector.

Plug Power (NASDAQ:PLUG) has drawn the attention of a number of billionaires, with giant BlackRock’s Larry Fink jumping in head first. Why? Because Plug Power is already providing its hydrogen-powered tech solutions to big-name retailers, but overall, because the green revolution is clearly happening and unfolding as we speak.

It’s even drawing the attention of major financial forces. Morgan Stanley’s Stephen Byrd, for example, thinks green hydrogen will become economically viable quicker than investors expect, noting Plug Power’s deal with Apex Clean Energy to develop a green hydrogen network using wind power offers a chance to tap into „very low cost“ renewable power and helps accelerate the shift to clean energy. Plug has a goal for over 50% of its hydrogen supplies to be generated from renewable resources by 2024.

Plug Power is already riding high the hydrogen hype. Its share price is up over 550% since last May, and it’s showing no signs of slowing. Hydrogen is already being touted as the fuel of the future, and a vital component in the world’s race to reduce carbon emissions. California-based Bloom Energy (NYSE:BE) is a company that designs, manufactures, and sells solid-oxide fuel cell systems. This means the emissions are less and there is no need to import fossil fuels, like oil or coal. The Bloom Box can be used in buildings and industries with high electricity needs, such as hospitals, data centers, and factories.

The company has been around for 15 years but it wasn’t until 2008 that they had their first customer (Google). Bloom was able to get this contract because of how reliable the technology was when compared to solar panels or wind turbines. And, yes, there’s been a ton of cash burn up to this point, but it’s heralding massive innovation–and that’s what tech startups are all about. Growth runways, not immediate profit.

And this could all be about to get even bigger. Why? Because this relatively small company is thinking in huge terms: We’re not just talking about fuel cells for construction vehicles or to power remote electricity generation … Bloom is thinking far bigger than that. It’s targeting utility-scale applications of fuel cells and industrial-scale applications and drawing in some very big names in the process.

Magna International (NYSE:MGA; TSX:MG) is a really interesting and roundabout way to get in on the explosive commodity market without betting big on one of the new hot stocks tearing up among the millennials right now. More than a decade ago, Magna International was already making major moves in the battery market, investing over half a billion dollars in battery production while the market was still in its infancy. At the time, electric vehicles as we know them had barely hit the scene, with Tesla launching its premiere car just two years prior.

Magna’s massive investment in batteries, however, has paid off in a big way. Since its controversial bet of yesteryear, the company has seen its valuation soar by tens of billions of dollars, and it has solidified itself as one of the leaders in the increasingly competitive battery business.

Orocobre (TSX:ORL) has had some serious problems in the past, and its stock price has fallen significantly from January 2018 highs. The company’s flagship project is the Salar de Olaroz lithium project located in the Jujuy province of northern Argentina.

Despite the fact that EV makers are using some 76% more lithium to produce battery packs this year, Orocobre’s CEO Perez de Solay voiced concern about price volatility and with it the increasing difficulty to find financing for new products.

Canada’s renewable energy push is gaining speed, as well. Boralex Inc. (TSX:BLX) is one of Canada’s premier renewable energy firms. It played a major role in kickstarting the country’s domestic renewable boom. The company’s main renewable energies are produced through wind, hydroelectric, thermal and solar sources and help power the homes of many people across Canada and other parts of the world, including the United States, France and the United Kingdom.

Shaw Communications Inc. (TSX:SJR) is a major player in the Canadian telecoms sector. It owns a ton of infrastructure throughout Canada and its cloud services and open-source projects look to address some of the biggest issues that its customers might face before the customers even face them. As online gaming depends on solid internet connections, Shaw will likely become a backdoor benefactor in increased online activity. Not only that, it’s growing higher on ESG investors’ lists, as well, thanks to its forward-thinking approach to the environment and its governance.

Telus Corporation’s (TSE:T) long-standing commitment to putting its customers first fuels every aspect of its business, has had it a definitive leader in Canada. In fact, Telus Health is one of the country’s biggest healthcare IT providers. And it’s done so with sustainability in focus. Driven by its goal to connect all Canadians for good, it has contributed over $55 in community giving, reduced emissions by 31% and has four consecutive years on the Dow Jones Sustainability World Index.

By. Alejandro Martinez

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the global demand for ammonia and hydrogen as commodities will continue to increase; that the research and development in the energy sector will lead to adoption of hydrogen and ammonia as commercially viable fuel sources for the automotive, aircraft, marine, industrial or other sectors in the future; that governments will continue to implement initiatives supporting reduced carbon emissions and that ammonia and hydrogen will gain traction and commercial viability as potential carbon-free or low carbon fuel alternatives; that AMMP will be able to develop an efficient process and proprietary intellectual property for the production of green ammonia and that AMMP’s process, if developed, will be adopted commercially to allow use of green ammonia and/or hydrogen as a viable fuel sources; that AMMP will meet its proposed development program and funding milestones to develop its technology process and produce the proposed AMMP power units; that AMMP will be able to establish its proposed manufacturing facility and produce ammonia power units which will be sold as commercially viable fuel alternatives; that investors will continue to seek opportunities for investment in green technologies and that hydrogen and ammonia will be considered as viable investment opportunities in the future; and that AMMP can carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include the global demand for ammonia and hydrogen may not continue to increase if other energy alternatives such as solar, wind or hydroelectric are favored over ammonia and hydrogen; that the research and development in the energy sector may lead to rejection of hydrogen and ammonia as commercially viable fuel sources for the automotive, aircraft, marine, industrial or other sectors in the future, and that research may find that other fuels or energy sources provide safer, more cost efficient and/or more viable fuel alternatives; that governments may not implement the anticipated funding and initiatives to support reduced carbon emissions sufficient for ammonia and hydrogen to gain necessary traction or commercial viability as fuel alternatives; that AMMP may be unable to develop an efficient process or any unique proprietary intellectual property for the production of green ammonia or, even if developed, may ultimately fail to be adopted as commercially viable for various reasons; that AMMP may be unable meet its proposed development timeline and funding milestones to develop its technology process and produce the proposed AMMP power units; that AMMP may be unable to establish its proposed manufacturing facility and produce ammonia power units, or if such units are developed, that they may not be sold as commercially viable fuel alternatives; that investors favour other clean energy opportunities than hydrogen and ammonia or that other fuel alternatives such as solar, wind and hydroelectric may be considered more commercially viable; and that AMMP may, for any number of reasons, fail to carry out its intended business plans. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively, “Oilprice.com”) are being paid ninety thousand USD for this article as part of a larger marketing campaign for CSE:AMMP. In addition, AMMP has issued 500,000 restricted stock units to Oilprice which will unconditionally convert to common shares after 4 months. The information in this report and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner and affiliates of Oilprice.com own shares and/or other securities of AMMP and therefore have an additional incentive to see the featured company’s stock perform well. Oilprice.com is therefore conflicted and is not purporting to present an independent report. The owner and affiliates of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation, nor are any of its writers or owners.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.

Read this article on OilPrice.com

[ad_2]

Source