1. Introduction

Nvidia Corp. is an American multinational technology company. It designs graphics processing units (GPUs) for the gaming and professional markets, as well as system on a chip units (SoCs) for the mobile computing and automotive market.

In addition to GPU manufacturing, Nvidia provides parallel processing capabilities to researchers and scientists that allow them to efficiently run high-performance applications. They are deployed in supercomputing sites around the world. More recently, it has moved into the mobile computing market, where it produces Tegra mobile processors for smartphones and tablets as well as vehicle navigation and entertainment systems. Nvidia is also now focused on artificial intelligence.

Nvidia´s product line:

Nvidia’s product line includes primarily graphics, wireless communication, PC processors, and automotive hardware/software

- GeForce, consumer-oriented graphics processing products

- Quadro, computer-aided design and digital content creation workstation graphics processing products

- NVS, multi-display business graphics solution

- Tegra, a system on a chip series for mobile devices

- Tesla, dedicated general-purpose GPU for high-end image generation applications in professional and scientific fields

- nForce, a motherboard chipset created by Nvidia for Intel (Celeron, Pentium and Core 2) and AMD (Athlon and Duron) microprocessors

- Nvidia GRID, a set of hardware and services by Nvidia for graphics virtualization

- Nvidia Shield, a range of gaming hardware including the Shield Portable, Shield Tablet and, most recently, the Shield Android TV

- Nvidia Drive automotive solutions, a range of hardware and software products for assisting car drivers. The Drive PX-series is a high performance computer platform aimed at autonomous driving through deep learning, while Driveworks is an operating system for driverless cars.

2. Analysis

Nvidia is the world leader in accelerated computing. Nvidia´s invention of the GPU in 1999 sparked the growth of the PC gaming market, redefined modern computer graphics and revolutionized parallel computing. More recently, GPU deep learning ignited modern AI – the next era of computing – with the GPU acting as the brain of computers, robots and self-driving cars that can perceive and understand the world. Nvidia combines a lot of super high growth sectors such as: gaming, professional visualization, data centres, automotive and AI.

Accordingly, the stock is loved by many investors. The 1 year return as of 16.02.2021 sits at a whopping 106%. If you bought at the very low on 16th March 2020, your return would be a staggering 212%!

The most important question is: are these returns backed by the numbers?

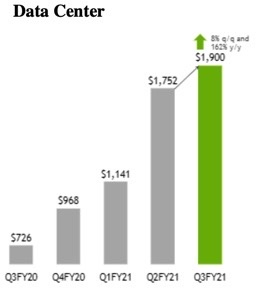

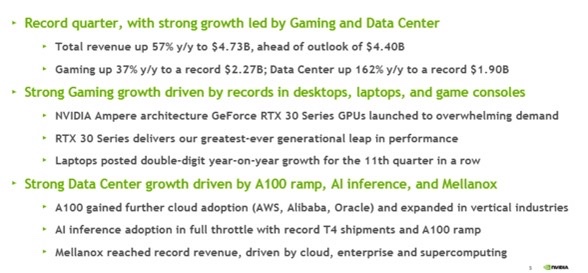

Let´s have a look at the third quarter 2020 Highlights:

As can be seen on the slide from Nvidia´s earnings presentation, all aspects and segments of the company is experiencing record growth. This could be attributable to the pandemic giving a boost in sales to some segments like gaming and laptop sales – since everyone is locked in their homes and are also on home office duty.

When a behemoth like Nvidia (with a market cap of close to 380 billion USD) can grow their revenue at these rates, it is quite logical that the share price rises as much if not even more!

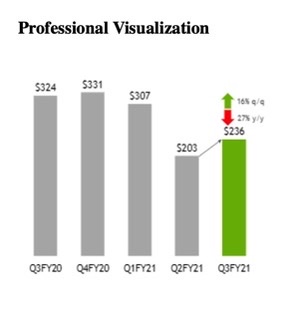

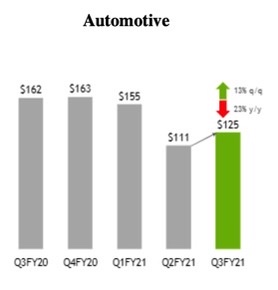

Here is a better visualization of the numbers per segment:

Furthermore, the balance sheet of Nvidia is amazing, with 10 billion USD in cash and under 6 billion of long term debt the company is set up for a good future:

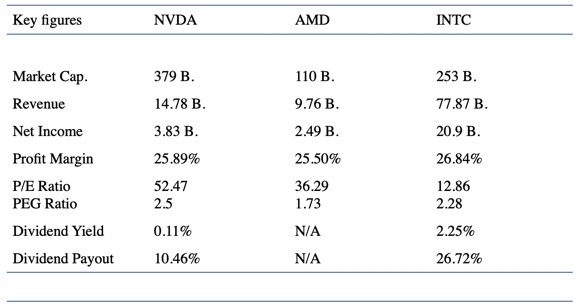

3. Ratio analysis and comparison to peers

4. Outlook

As mentioned above, most of Nvidia´s growth in the past 3 quarters have definitely received a push from the Covid-19 pandemic. With many governments issuing a lockdown and Home Office obligation, the gaming/laptop/PC sectors have boomed.

This will probably continue as many companies will implemented Home Office into their regular schedule after the pandemic. The addictive part of gaming will let the gamers continue playing and searching for better gear and specs, therefore upgrading their current set-up. Not only this, but with Nvidia being active in pretty high growth and important sectors (as can be seen on the next image), one is expected to pay a premium but also hopefully lock in some profits.

This Stock-Report was created in cooperation with Coldxice. This report is not investment advice. It is only intended to introduce the company mentioned above.

Disclaimer

All information in this report is assumed to be accurate to the best of our ability. Tikenomics.com and Coldxice excludes all liability, to the maximum extent permitted by law, for any inaccuracies in the Content or for the consequences of your reliance on the Content. Investors should consider this report as only a single factor when making an investment decision.