Cadence Design Systems, Inc. provides solutions that enable its customers to design electronic products. The Company’s product categories include Functional Verification, Digital integrated circuits (IC) Design and Signoff, Custom IC Design and Verification, System Interconnect and Analysis, and intellectual property (IP). Functional verification products are used to verify that the circuitry or the software designed will perform as intended. Digital IC design offerings are used to create representations of a digital circuit or an IC that can be verified for correctness prior to implementation. Custom IC design and verification offerings are used to create schematic and physical representations of circuits down to the transistor level for analog and memory designs. System Interconnect and Analysis offerings are used to develop printed circuit boards and IC packages. Design IP offerings consist of functional blocks, which customers integrate into their ICs for the development process.

Cadence Design Systems began as an electronic design automation (EDA) company, formed in 1988 by the merger of Solomon Design Automation (SDA), founded in 1983 by Richard Newton, Alberto Sangiovanni-Vincentelli and James Solomon, and ECAD, a company founded in 1982 by Glen Antle and Paul Huang. Part of the business policy has always been the acquisition of smaller companies. In 1999, OrCAD was acquired, which offered the eponymous software for the design of printed circuit boards as the market leader. Cadence now distributes OrCAD products as part of the Allegro platform. In 2003, Verplex Systems, a provider of Formal Verification and Equivalence Check software.

2005: Acquisition of Verisity, Ltd, a provider of verification software. 2008: Acquisition of ChipEstimate, a developer of chip planning software and IP management. 2020: Acquisition of AWR for the design and simulation of high frequency electronics.

In January 2009, Cadence’s board of directors voted unanimously to re-elect Lip-Bu Tan as president and CEO. Tan was most recently CEO of Walden International, a venture capital firm of which he remains chairman. In 2017, Cadence named Anirudh Devgan president, reporting to Lip-Bu Tan.

TECHNICAL ANALYSIS

FUNDAMENTAL INDICATORS

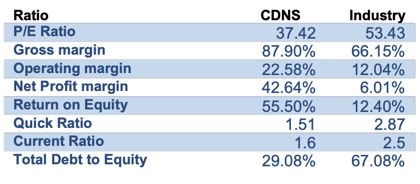

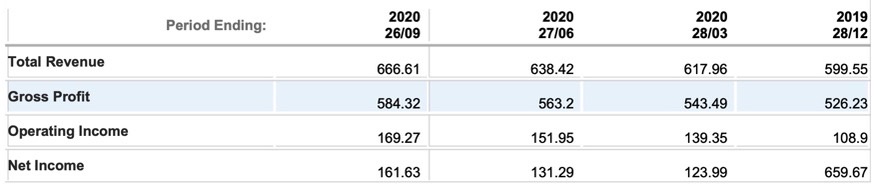

While CDNS has a great profitability rating, there are some minor concerns on its financial health. While showing a medium growth rate, CDNS is valued expensive at the moment. CDNS’s Return on Assets of 26.00% is amongst the best returns of the industry. CDNS outperforms 98% of its industry peers. The Price/Earnings Ratio is 37.84, which means the current valuation is very expensive for CDNS. With a Forward Price/Earnings Ratio of 73.58, CDNS is valued very expensively. CDNS shows a strong growth in Earnings Per Share. In the last year, the EPS has been growing by 153.29%, which is quite impressive. Based on estimates for the next 2 years, CDNS will show a very negative growth in Earnings per Share. The EPS will decrease by -25.11% on average per year. When comparing the Current Ratio of CDNS to the average industry Current Ratio of 1.90, CDNS is less able to pay its short term obligations than its industry peers.

The final conclusion is the following:

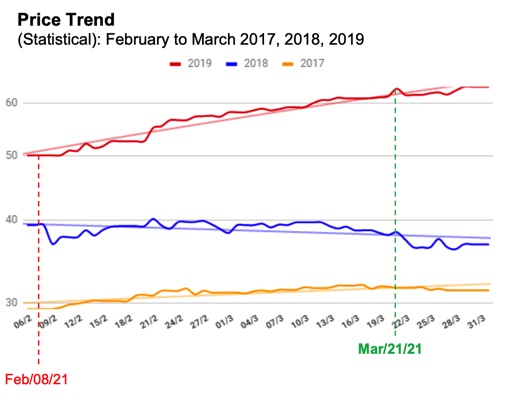

While Cadence Design Systems Inc. has a great profitability rating; there are some minor concerns on its financial health. While showing a medium growth rate, CDNS is valued expensive at the moment. For the period February to March (2017, 2018, 2019) the stock price shows a Statistical uptrend of 3.86%.

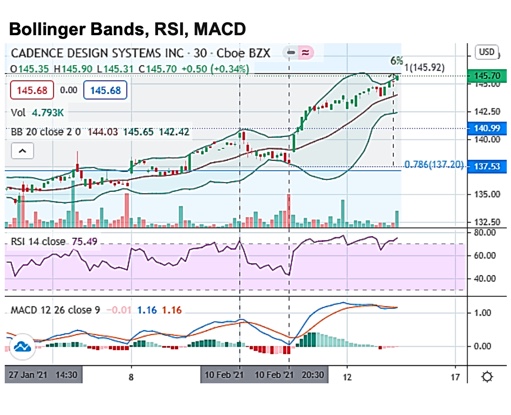

From January 27 to February 10 2021 price went up 14.5% to $145.92 (25 week ́s high) Today at end of session both MACD and RSI show downtrend indication.

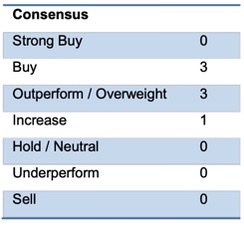

Based in the present analysis of Cadence Design Systems Inc. (CDNS). The recommendation is TO REDUCE your position.

This Stock-Report was created in cooperation with Guía traders® and the analyst (Miguel Peraza). This report is not investment advice. It is only intended to introduce the company mentioned above.

DISCLAIMER

All information in this report is assumed to be accurate to the best of our ability. Tikenomics.com, Guía traders® and the analyst (Miguel Peraza) excludes all liability, to the maximum extent permitted by law, for any inaccuracies in the Content or for the consequences of your reliance on the Content. Investors should consider this report as only a single factor when making an investment decision