Chipmaker Intel (INTC) late Thursday easily beat Wall Street’s targets for the second quarter thanks to robust PC processor sales. But data center chip sales disappointed. Intel stock fell in extended trading.

X

The Santa Clara, Calif.-based company earned an adjusted $1.28 a share on sales of $19.63 billion in the June quarter. Analysts expected Intel earnings of $1.07 a share on sales of $17.81 billion, according to FactSet. On a year-over-year basis, Intel earnings rose 4% while sales dipped a fraction.

Intel’s sales now have fallen for four straight quarters year over year. But its earnings returned to growth after three consecutive flat or down quarters.

„Our second-quarter results show that our momentum is building, our execution is improving, and customers continue to choose us for leadership products,“ Chief Executive Pat Gelsinger said in a news release.

Intel Stock Falls On Data Center Drop

In after-hours trading on the stock market today, Intel stock slid 2.7%, near 54.45. During the regular session Thursday, Intel stock dipped 0.5% to 55.96.

Strong sales of personal computer chips helped to offset a decline in sales of data center chips in the June quarter. Intel’s PC chip sales rose 6% to $10.1 billion in the second quarter. However, data center chip sales dropped 9% from the year-earlier period to $6.5 billion.

Meanwhile, sales of chips for automotive and Internet of Things applications rose 61% to $1.3 billion.

Guidance Beats Consensus Estimates

For the current quarter, Intel expects to earn an adjusted $1.10 a share on sales of $19.1 billion. Wall Street had predicted Intel earnings of $1.09 a share on sales of $18.1 billion. In the third quarter last year, Intel earned $1.11 a share on sales of $18.3 billion.

For the full year, Intel forecast adjusted earnings of $4.80 a share on sales of $77.6 billion. Analysts were looking for earnings of $4.64 a share on sales of $72.7 billion.

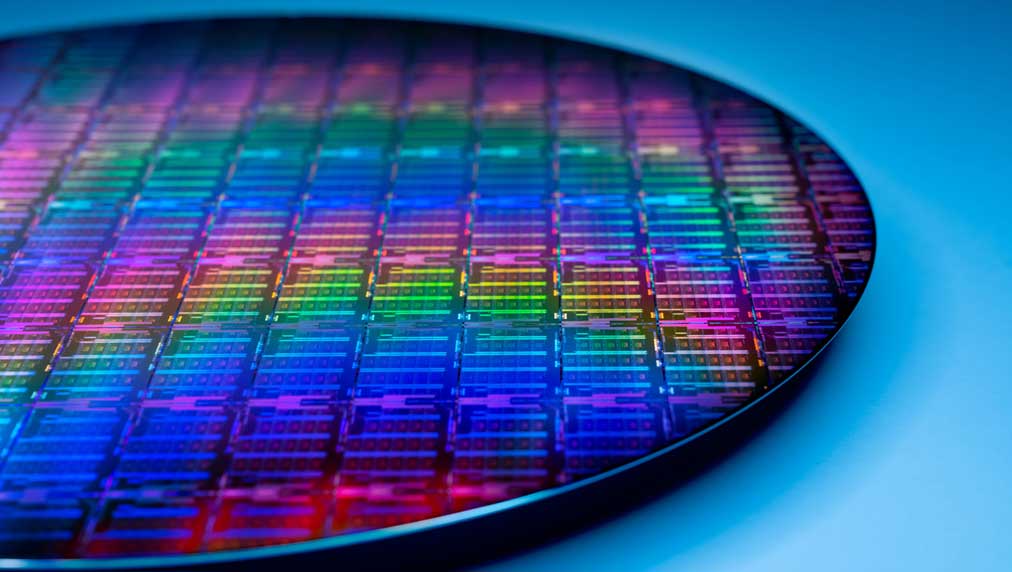

„There’s never been a more exciting time to be in the semiconductor industry,“ Gelsinger said. „The digitization of everything continues to accelerate, creating a vast growth opportunity for us and our customers across core and emerging business areas.“

Intel Stock Down Since Chip Delay

Intel stock has been consolidating for the past three months at a potential buy point of 68.59, according to IBD MarketSmith charts. But Intel has a poor track record of late for sustaining gains after stock breakouts.

Intel stock has been down since June 29 when the company revealed a delay in production of its next-generation Xeon data center processors. It pushed back production by about one quarter to the first quarter of 2022.

Last week, the Wall Street Journal reported that Intel was looking to buy GlobalFoundries in a deal potentially worth $30 billion. But GlobalFoundries Chief Executive Thomas Caulfield dismissed the report.

„There’s nothing to that story,“ he bluntly told CNBC on Monday.

Follow Patrick Seitz on Twitter at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

Texas Instruments Beats Second-Quarter Goals But Sales Outlook Lags

Chip Gear Maker ASML Tops Earnings Target, Guides Higher

Is AMD Stock A Buy Ahead Of Chipmaker’s Second-Quarter Earnings Report?

Find Winning Stocks With MarketSmith Pattern Recognition & Custom Screens

Check Out Leaderboard’s 10-Year Anniversary Sale

[ad_2]

Source