Stock-Analysis of Roku Inc. (ROKU)

Business Fundamentals: ROKU Inc (ROKU)

Business Overview

Roku, Inc. operates television streaming platforms. The company operates in two segments, Platform and Player. Its platform allows users to discover and access various movies and TV episodes, as well as live sports, music, news, and others. The Company connects users to streaming content, enables content publishers to build and monetize audiences and provides advertisers with capabilities to engage consumers. Its Rolcu platform allows users to personalize their content selection with cable television replacement offerings and other streaming services that suit their budget and needs. Ad-supported channels available on the Roku platform include CBS News, Crackle, The CW Television Network and Vice; subscription channels include HBO Now, Hulu and Netflix, as well as traditional pay TV replacement services like DirecTV Now, Sling TV and Sony PlayStation Vue; and transactional channels include Amazon Video, Google Play and Vudu. In addition to the streaming services, the company also offers streaming media players and accessories under the Roku brand name; and sells branded channel buttons on remote controls.

Roku is the leading streaming platform in the U.S. by hours watched with over 40 billion hours of content streamed in 2019. As well as the traditional streaming services, the company also offers its own ad-supported content channels which feature licensed third- party content. Roku generates revenue from advertising, distribution fees, hardware sales, and subscription sales.

Roku operates in a very competitive market but has shown remarkable growth over the past five years as the company has adopted a duel operation approach. Roku has embraced two sectors of streaming: over the top viewing and smart TV adoption. At the of September 2020, the firm has announced they have 46 million active users. Roku, lime other streaming services has benefited enormously from indirect impacts of COVID-19 and stay at home orders, boosting user engagement and streaming hours.

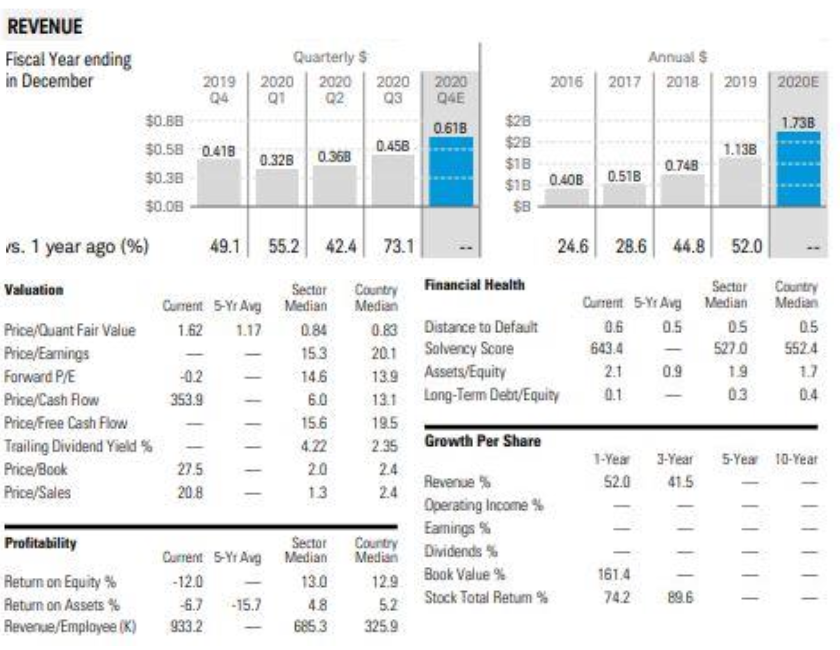

The bulk of Roku’s users and revenue are generated in the United States market where the firm’s penetration is over 40% of broadband households. Most of the revenue growth will continue to come from higher ad rates and subscription sales. The company forecasts one of the greatest opportunities will be from overseas user engagement. They also realize that the large tech giants, Google, Amazon, and Apple are positioned better to grow rapidly.

Once of the key standouts ROKU has been able to offer compared to other streaming services is the neutral approach. Roku has not been biased when placing services on their platform, a striking difference to Amazon and Google. Investors are still on the fence if

this business strategy is positive. It has been interesting to note that HBO MAX and Peacock were not originally launched on the ROKU. This could signal an adjustment in strategy over the coming years.

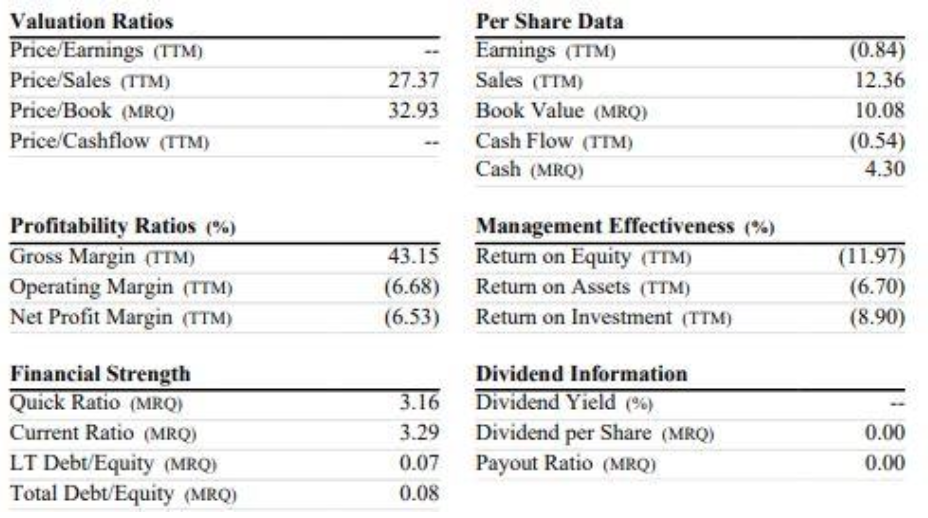

Business Finances

2020 has been very good to Roku. The company’s year-over-year growth rate in active accounts, accelerated throughout the year as consumers have been sheltering at home and are turning to the leading smart TV operating system. The companies operating system is used not only in Roku’s own hardware but in co-branded TVs and soundbars from manufacturers lime TCL, Onn, and Hisense.

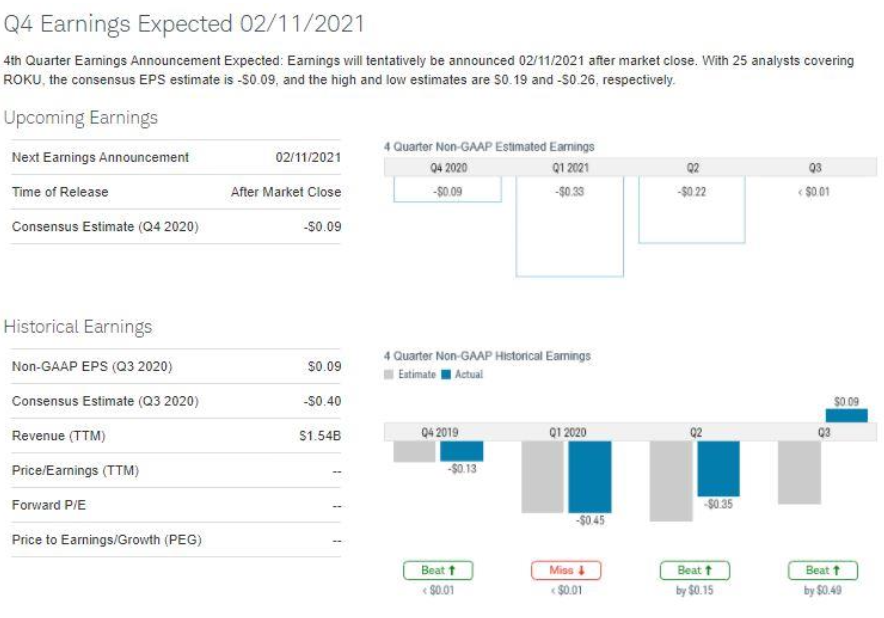

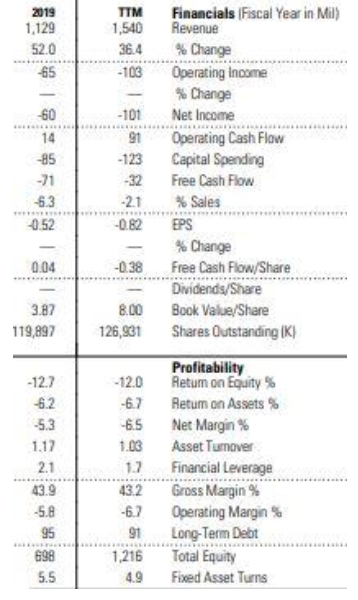

Roku announced strong third-quarter earnings on Nov. 5, with active accounts up over 43% vear over year to 46.0 million and streaming hours up to 54% versus a year ago to 14.8 billion in the quarter. As a result, revenue improved by 73% to $452 million. Player revenue grew by 62% to $132 million as unit sales were up over 57% in the quarter. Roku OS powered over one third of the smart TVs sold in the U.S this year. Monetized ad impressions were up almost 90% versus a year ago and first-time advertisers more than doubled. Roku is well positioned to take advantage of the secular trend toward increased content streaming in the U.S and abroad, and the service-neutral stance will continue to attract both new streaming services and customers. However, despite their enormous subscriber growth ROKU has yet to generate operating income and there may not be substantial leverage in the current business model. Ad revenue will continue to drive growth but that the pace may be moderated from the pandemic-influenced highs of the last two quarters. Increasing saturation in the U.S. and stiff competition internationally will also likely pressure growth in the coming years.

Technical Analysis: Roku INC (ROKU)

ROKU appears to be correcting within a longer-term bullish trend. The MACD is presently below the signal line, shares remain 90.3% above an upwards sloping 200-day moving average. Comparative Relative Strenqth analysis shows that this issue is outperforming the S&P 500. Momentum is waning as measured by a 14-period Slow Stochastic Oscillator. This means that investors are less aggressive in their recent purchases and may even be taking profits in positions bought at lower prices. The On Balance Volume indicator is bullish. The slope of the indicator is positive and suggests that buyers are presently more active than sellers. Presently, the Bollinqer Bands for ROIS are of a normal width, and signal that volatility has been in-line with the norm for this stock.

The current technical condition for ROKU is strong and the chart pattern suggests that upward momentum should continue. Over the last 50 trading sessions, there has been more volume on up days than on down days, indicating that ROKU is under accumulation, which is a bullish condition. The stoclc is trading above a rising 50-day moving average. This validates the strong technical condition for ROKU. The stock is above its 200-day moving average which is pointed up indicating that the intermediate term trend is bullish.

Buy or Sell: ROKU INC (ROKU)

When 3rd quarter report was released, the earning beat the broader markets expectation by $0.49. This was a great result for the company, pushing the stock up from $220 to $260. From this moment the stock has continue to skyrocket. Around Christmas time, ROKU hit a 12-month high of $363.44. Since then, there has been a slight pull back down to $330, which represent the moving average range achieved during the month of December.

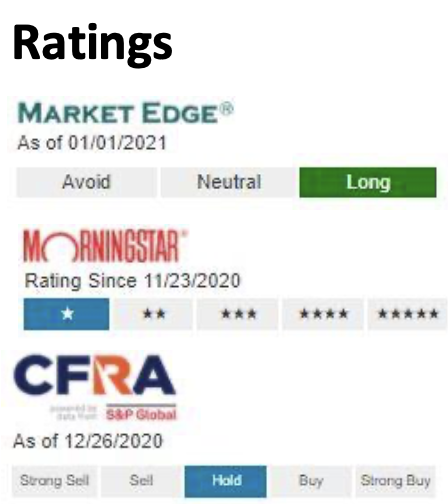

Analysts on Wall street have mixed price targets and ratings. It is split between Buy and Sell, with the average price target set to $274. This would represent a pullback of 17% from the current price. The big question is why are the price targets and ratings are so mixed?

An investor can draw one clear conclusion, uncertainty. The fundamentals of the company are improving and the enormous success of the increased revenue, users, income etc. is fantastic. However, the current market value is very high. The stock was moving well into the overbought territory around Christmas time, however since then has pulled back and is now sitting comfortably by way of technical observation. The key metric to observe is the new streaming agreements and international expansion, both of which could prove to be strong catalysts over the coming years.

Entry and Exit Positions: ROKU Inc (Roku)

If you believe Roku is a good investment (we do), then we recommend entering at this level.

Entry:

Above, we have provided one blue resistance line at approximately $331. This resistance line is the average stock price of ROKU during the month of December. We believe the stock should not be trading below this level, and once the stock breaches this line, an entry position has been developed. We believe ROKU’s neutral business model will work well, as customers can select one

device and gain access to the wide range of different channels. Furthermore, the price points of their devices continue to be attractive to the consumer, hopefully creating a long-term relationship.

Exit: As you may notice we have not provided an exit target line. Ifyou enter ROKU at $331, we believe this could be a solid long-term investment. Currently the company does not pay a dividend, but business models can change over the coming years. It is very difficult to put an exit position on this company, but we do believe it will increase not decrease over the next 12-months. An active trader could trade the swings for this stock and a conservative investor could add this to their long-term portfolio.