BUSINESS SUMARY

DocuSign, Inc. provides electronic signature solutions. The

Company offers its services to mortgage, non-profit,

government, real estate, insurance, technology, and

healthcare industries. DocuSign serves customers

worldwide. Founded 03/17/2015.

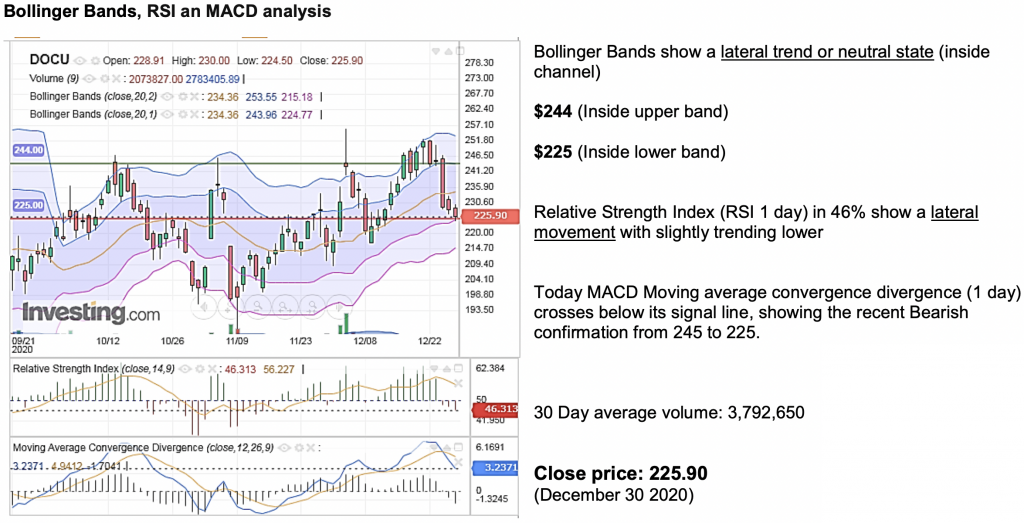

TECHNICAL ANALYSIS

Statistical

FUNDAMENTAL INDICATORS

For the nine months ended 31 October 2020, Docusign Inc. revenues increased 46% to $1.02B. Net loss increased 6% to $170.9M. Revenues reflect United States segment increase of 43% to $824.3M, International segment increase of 61% to $197.8M. Higher net loss reflects Sales and marketing -Balancing value increase of 34% to $471.7M (expense), Research and development – Balancing increase of 42% to $145.8M (expense).

Docusign has presented 3 positive earnings reports, revenue growth is strong, making it easier to raise capital if need be, company´s finances are not negative with the third quarter number hitting $382.9 million; the liabilities are just about equal to its liquid assets.

The company’s gross margin has been higher than its industry average; the net margin has been 10% lower the industry average.

Current Ratio: The company’s liquidity has been lower than its industry but the cash flow is 57.44 Millions USD.

Debt: The company’s debt is significantly high compared with the industry but the ratio debt to assets is 33.44%. For fiscal 2021, the company sees revenue to range between $1.426 billion and $1.430 billion, with Subscription revenue of $1.355.

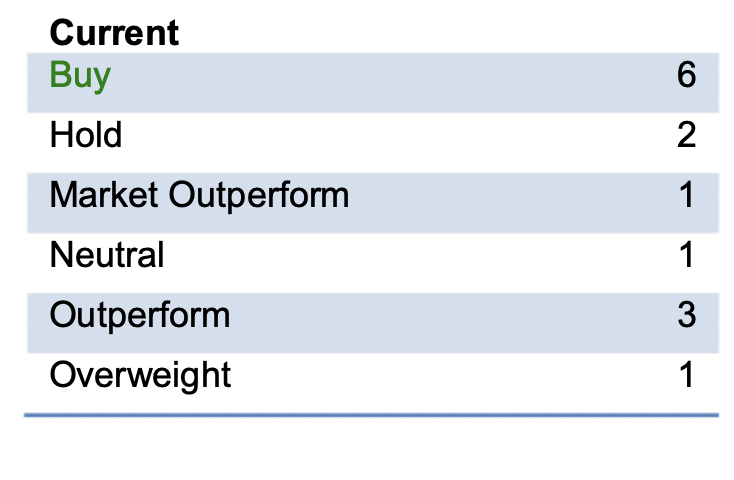

ANALYSTS INFORMATION

Current Situation

Certainly Docusign got a boost from the pandemic as well as the other companies in the sector.

The technical analysis shows a lateral or neutral trend in short

term, however the statistical analysis, fundamentals analysis

and the opinion of analyst show an uptrend, possibly following

the channel between 205 and 273.

This Stock-Report was created in cooperation with Guía traders®. This report is not investment advice. It is only intended to introduce the company mentioned above.

Disclaimer

All information in this report is assumed to be accurate to the best of our ability. Tikenomics.com, Guía traders® and the analyst (Miguel Peraza) excludes all liability, to the maximum extent permitted by law, for any inaccuracies in the Content or for the consequences of your reliance on the Content. Investors should consider this report as only a single factor when making an investment decision.