(Bloomberg) — Asian stocks and U.S. equity futures fell Monday as Russia’s war in Ukraine grinds into a second month and the risk of an economic downturn from tightening U.S. monetary policy hangs over markets.

Most Read from Bloomberg

Shares lost ground in Japan and South Korea but edged up in Australia. S&P 500 and Nasdaq 100 contracts retreated, signaling a possible pause in the global rally in equities from the lows sparked by the conflict.

China’s Covid-linked lockdown in Shanghai may sap the mood when Hong Kong and the mainland open later. West Texas Intermediate crude slid to around $110 a barrel partly on concern that China’s virus resurgence imperils demand.

Treasuries were mixed in the wake of a bond rout, which has been driven by fears that the Federal Reserve will lead an aggressive global wave of interest-rate hikes to quell elevated inflation.

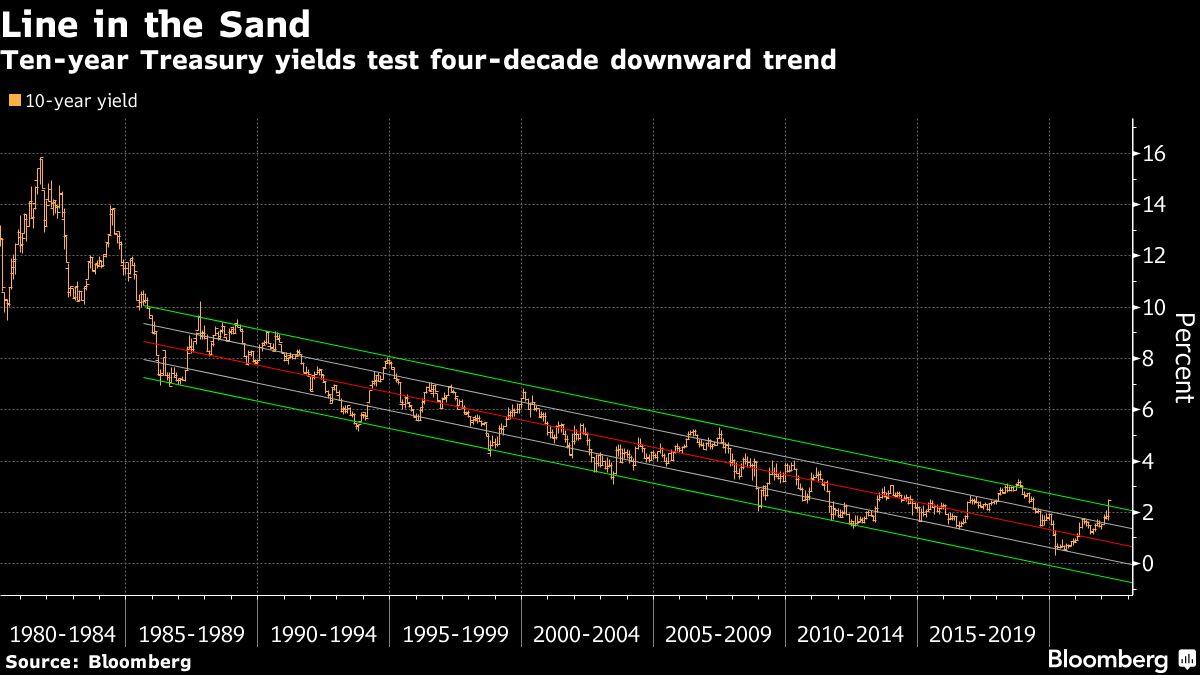

The 10-year U.S. Treasury yield dipped but remains above a technical trend line that has effectively served as a ceiling since the late 1980s. Bonds tumbled in Australia and New Zealand. A dollar gauge advanced, while the yen was around a six-year low against the greenback.

The war continues to disrupt the supplies of key commodities, stoking inflation risks that are contributing to expectations of more aggressive Fed tightening. Traders are pricing in two full percentage points of Fed rate rises over the rest of 2022. That backdrop has the potential to inject further volatility across stocks, bonds and currencies.

“The Fed is trying to create a Goldilocks scenario by engineering a soft landing,” Saira Malik, chief investment officer at Nuveen, said on Bloomberg Television. “The equity markets are buying it and the bond markets aren’t.”

Malik said she expects only a moderate impact on global growth from the war, adding economic expansion will be strong enough to overcome inflation.

In-person talks between Ukrainian and Russian negotiating teams will resume this week, according to officials. U.S. officials are in damage control after President Joe Biden said Vladimir Putin “cannot remain in power.” Secretary of State Antony Blinken said the U.S. doesn’t have a strategy of regime change.

While global shares have recovered from the lows sparked by Russia’s invasion, questions remain about the durability of the equity market advance.

It may be that what we’re seeing is “more a bear-market rally,” Chris Weston, head of research with Pepperstone Financial Pty, wrote in a note. He added that investment flows related to portfolio rebalancing at the end of March and the first quarter could lead to “big and questionable moves.”

In cryptocurrencies, Bitcoin scaled $46,000 following a recent rally that’s enabled the digital token to erase losses and turn positive for the year.

Some key events to watch this week:

-

President Joe Biden due to release his 2023 budget, Monday

-

Bank of England Governor Andrew Bailey to speak, Monday

-

Australia’s annual budget, Tuesday

-

Philadelphia Fed President Patrick Harker to speak, Tuesday

-

U.S. GDP, Wednesday

-

Richmond Fed President Thomas Barkin to speak, Wednesday

-

China manufacturing, non-manufacturing PMIs, Thursday

-

OPEC and non-OPEC ministerial meeting to discuss production targets, Thursday

-

New York Fed President John Williams to speak, Thursday

-

U.S. jobs report, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.2% as of 9:27 a.m. in Tokyo. The S&P 500 rose 0.5% Friday

-

Nasdaq 100 futures fell 0.3%. The Nasdaq 100 fell 0.1% Friday

-

Japan’s Topix index shed 0.3%

-

South Korea’s Kospi index lost 0.5%

-

Australia’s S&P/ASX 200 index rose 0.4%

Currencies

-

The Japanese yen was at 122.28 per dollar, down 0.2%

-

The offshore yuan was at 6.3885 per dollar

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was at $1.0977

Bonds

Commodities

-

West Texas Intermediate crude fell 3.9% to $109.47 a barrel

-

Gold was at $1,955.78 an ounce, down 0.1%

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Source