(Bloomberg) — U.S. equity futures retreated and Asian stocks struggled Tuesday amid a jump in Treasury yields as investors girded for interest-rate hikes by the Federal Reserve to quell high inflation.

Most Read from Bloomberg

Treasuries fell across the curve, pushing two-year and 10-year yields up to levels last seen before the pandemic roiled markets. Pressure is growing for the Fed to act more quickly to contain price pressures, which are being stoked in part by a rally in oil that’s taken Brent crude to the highest since 2014.

Nasdaq 100 contracts fell about 1%. S&P 500 and European futures were in the red too. U.S. markets reopen later from a holiday. MSCI Inc.’s Asia-Pacific share gauge turned lower, though China hung on to gains in the slipstream of interest-rate cuts Monday that spurred expectations of more policy easing.

The dollar rose and commodity-linked currencies fell. The yen dipped after the Bank of Japan sat pat on policy while nudging up its inflation projection.

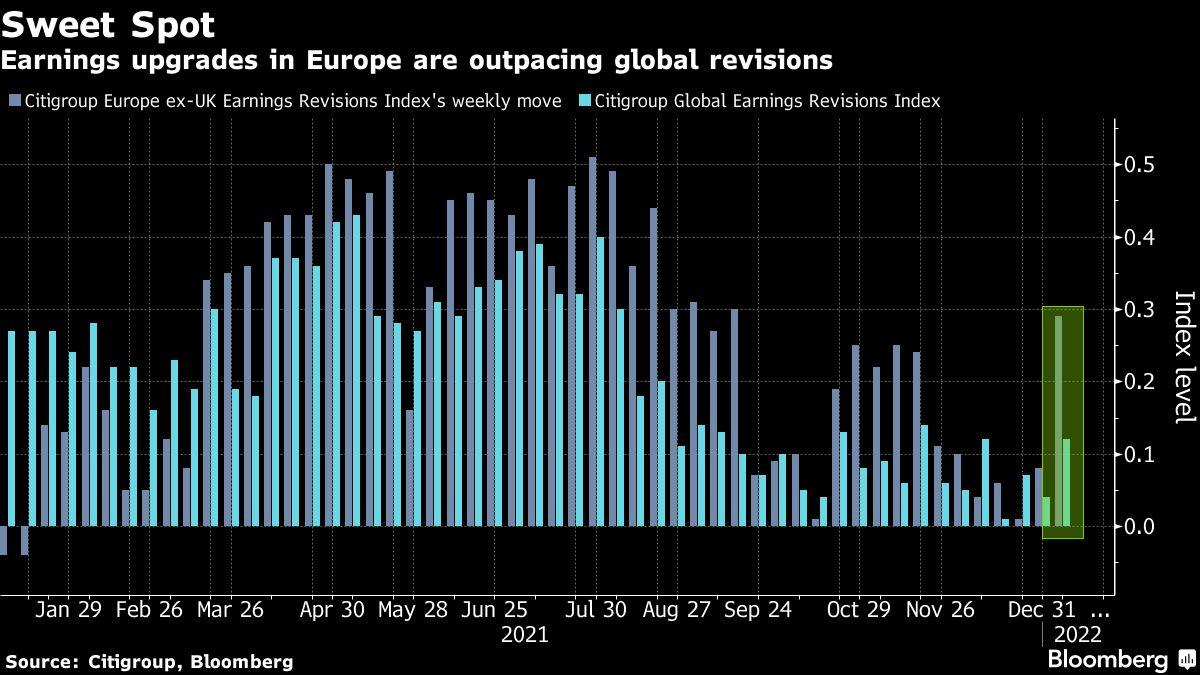

Global stocks have declined this year, hurt by a retreat in U.S. shares. A key question now is whether company profits will revive sentiment by weathering higher costs and challenges from the omicron virus strain.

“It will be interesting to see if investors are tempted back in now that earnings season is underway,” Craig Erlam, senior market analyst at Oanda, wrote in a note. “The emergence of omicron may mean that many companies don’t enjoy the kind of performance that was expected before, but that doesn’t mean there won’t be plenty of positives to take away.”

JPMorgan Chase & Co. strategists contend that global corporate earnings will deliver significant beats this year, again defying doomsayers and skeptics.

In the energy sector, easing concerns about the impact of omicron on demand together with shrinking oil inventories are contributing to forecasts of $100 per barrel crude later this year.

The speculative corners of markets remained subdued amid the general mood of caution. Bitcoin traded at around $42,000, down about 9% so far this year.

For more market analysis, read our MLIV blog.

What to watch this week:

-

Goldman Sachs, Morgan Stanley, Bank of America, UnitedHealth Group and Netflix are among companies publishing earnings during the week

-

U.S. data includes Empire manufacturing Tuesday, housing starts Wednesday and jobless claims Thursday

-

Interest-rate decisions due from nations including Indonesia, Malaysia, Norway, Turkey and Ukraine, Thursday

-

EIA crude oil inventory report, Thursday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.4% as of 2:39 p.m. in Tokyo. The S&P 500 rose 0.1% on Friday

-

Nasdaq 100 futures fell 1.1%. The Nasdaq 100 rose 0.8% on Friday

-

Japan’s Topix index declined 0.3%

-

Australia’s S&P/ASX 200 index fell 0.1%

-

South Korea’s Kospi index fell 1%

-

China’s Shanghai Composite index rose 0.7%

-

Hong Kong’s Hang Seng index lost 0.4%

-

Euro Stoxx 50 futures shed 0.5%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was at $1.1399, falling 0.1%

-

The Japanese yen was at 114.79 per dollar, down 0.1%

-

The offshore yuan was at 6.3470 per dollar, up 0.1%

Bonds

-

The 10-year U.S. Treasury yield increased five basis points to 1.84%

-

Australia’s 10-year bond yield was at 1.95%, up three basis points

Commodities

-

West Texas Intermediate crude rose 1.5% to $85.05 a barrel

-

Gold was at $1,817.71 an ounce, falling 0.1%

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Source