(Bloomberg) — Stocks slid Monday and longer-term Treasury yields fell as investors soured on the reflation trade in the wake of a hawkish pivot by the Federal Reserve. The dollar remained at about a two-month high.

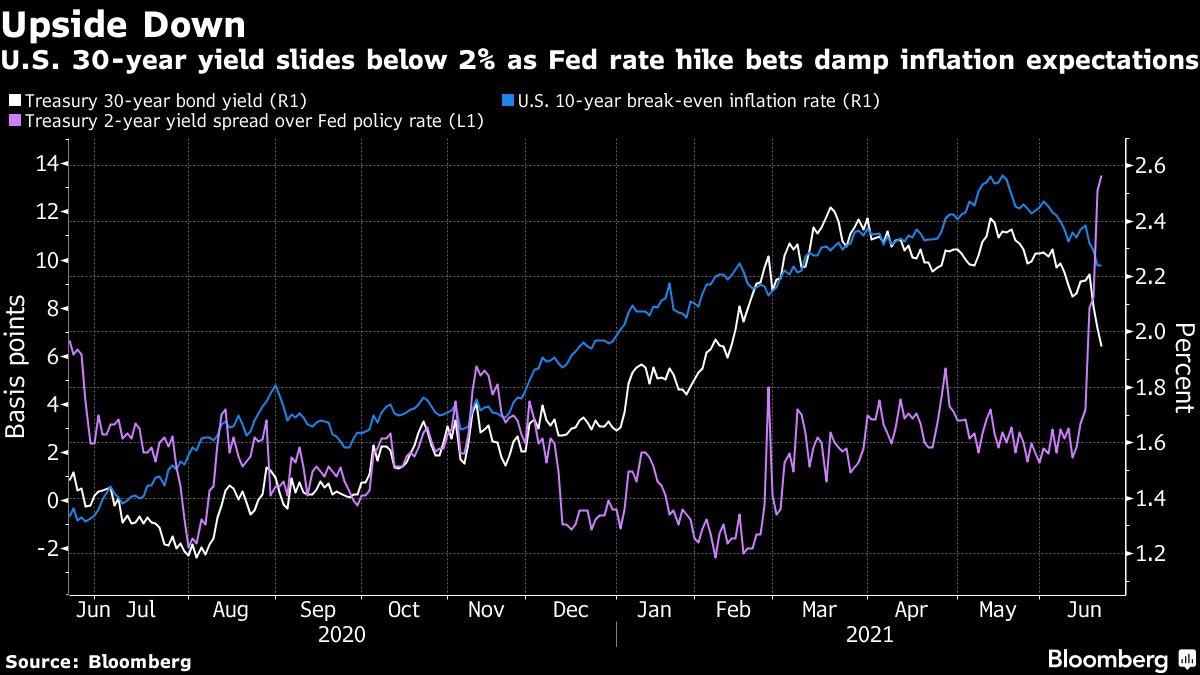

Japan led the Asian equity weakness, with the Nikkei 225 down as much as 4%, while European and U.S. stock futures declined. The 30-year U.S. Treasury yield retreated below 2% for the first time since February, as the prospect of less accommodative monetary policy buffeted markets.

The Treasury yield curve continued to flatten, unwinding one of this year’s dominant reflation bets. Short-maturity yields surged after Fed official James Bullard said inflation risks may warrant higher interest rates next year, an earlier liftoff than penciled in by many of his colleagues.

Gold stabilized after slumping last week. Oil climbed to about $72 a barrel as talks between world powers and Iran dragged on, potentially delaying the return of the latter’s energy exports.

Traders will be paying close attention to this week’s appearances by Fed policy makers, including Chair Jerome Powell, for more guidance on a possible timeline for tapering asset purchases. Last week, officials sped up their expected pace of policy tightening amid optimism about the labor market and heightened concerns over price pressures in the recovery from the pandemic.

“We have another possibly two years before the Fed starts to take action,” John Woods, Asia Pacific chief investment officer at Credit Suisse Group AG, said on Bloomberg Television. “So I do anticipate there will be a period of choppy, sideways trading as the volatility associated with this debate in the Fed is reflected in pricing, but absolutely I take the view that yields will tick a little higher.”

Elsewhere, cryptocurrencies fell back, hurt by a general worsening of investor sentiment as well as China’s ongoing crackdown on Bitcoin mining and the prospect of tighter regulations elsewhere.

For more market commentary, follow the MLIV blog.

Here are some events to watch this week:

St. Louis Fed President James Bullard, Dallas Fed President Robert Kaplan and New York Fed President John Williams are among Fed speakers, as traders weigh up the central bank’s messaging shift, which has the potential to whiplash assetsEuropean Central Bank President Christine Lagarde addresses the European Parliament MondayFed Chair Jerome Powell testifies at a House Subcommittee hearing on the Fed’s pandemic emergency lending and its asset purchase programs TuesdayBank of England interest rate decision Thursday

These are some of the main moves in financial markets:

Stocks

S&P 500 futures slipped 0.4% as of 7 a.m. in London. The gauge fell 1.3% FridayNasdaq 100 futures were 0.2% lower. The index fell 0.8%Japan’s Topix index shed 2.4%Australia’s S&P/ASX 200 Index dropped 1.6%South Korea’s Kospi index fell 1%Hong Kong’s Hang Seng Index declined 1.6%China’s Shanghai Composite Index retreated 0.3%Euro Stoxx 50 futures tumbled 1%

Currencies

The yen advanced 0.3% to 109.85 per dollarThe offshore yuan traded at 6.4733 per dollar, down 0.2%The Bloomberg Dollar Spot Index rose 0.1%The euro was at $1.1866

Bonds

The yield on 10-year Treasuries dipped five basis points to 1.39%Australia’s 10-year yield fell eight basis points to 1.51%

Commodities

West Texas Intermediate crude rose 0.3% to $71.82 a barrelGold rose 0.5% to $1,772.90 an ounce

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.

[ad_2]

Source