Private companies take a growing role, as innovations and data needs expand the sector.

On March 31, Blue Origin took five paying customers into outer space, just past the boundary of earth’s atmosphere. The 10-minute trip (price undisclosed) was the company’s fourth space tour; Blue Origin founder Jeff Bezos had himself taken the ride last July. But Richard Branson famously beat him into space, by a week, riding on one of Virgin Galactic’s first manned missions.

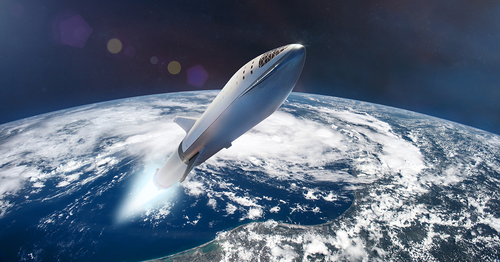

Welcome to the new space race. Such high-profile entrepreneurs are only the most visible edge of an entirely new sector of industry that is rapidly growing as new potential opens for the private sector. Some estimates put the space economy at $1.25 trillion by 2030. The new sector straddles satellite communications, Earth observation, situational awareness and space research.

A January report by Cambridge, Massachusetts-based consultancy Northern Sky Research (NSR) estimates that the satellite and space infrastructure market alone could be worth as much as $570 billion by 2030. This market is seeing strong demand in the crew and cargo domain and is currently the sector’s largest segment.

Still, NSR says that by the end of the decade, communications services, including satellite broadband internet, will displace infrastructure from the lead, providing a boon for major launch providers such as United Launch Alliance (a joint venture of Lockheed Martin Space and Boeing), Arianespace (a European consortium linked to Airbus), and SpaceX. Morgan Stanley estimates satellite broadband will represent 50% of the projected growth of the global space economy by 2040. Companies including Viasat, HughesNet, OneWeb and Kuiper Systems are vying in varying degrees to capitalize on the multibillion-dollar global opportunity. Satellite and space applications, which include Earth-observation information products, data analytics and data downlinks, constitute another important category and could see revenues of $140 billion by 2030, NSR predicts.

While it may seem as though buccaneering startups stole an early march on less agile corporates, today storied company names such as Lockheed Martin and Telesat are increasingly leveraging legacy capabilities to compete with hip startups, such as Hiber and Capella Space in the satellite market.

Galactic Gold Rush

But amid the galactic gold rush, analysts warn that the combination of controversial financial techniques, lack of regulation and the private sector’s role in the militarization of space, might bring the sector crashing down to Earth. The sector’s trillion-dollar valuation coincides with a move away from dominance by government agencies to complementary private sector partnerships.

Yet how the space economy is to be regulated, if it can be at all, is one of the biggest challenges confronting policymakers and companies alike. In a September paper written for the G20 Space Economy Leaders’ Meeting in Rome, the Paris-based Organization for Economic Cooperation and Development (OECD) says that “unprecedented, intensified use of Earth’s orbits” threatens the orbital environment and space infrastructure “with debris accumulating yearly.” According to the OECD, “Debris-related incidents and collisions could have significant negative consequences globally.”

And despite deepening relationships with government, the private sector’s role is sometimes contentious. China complained to the UN last December that its space station had been forced twice to perform emergency maneuvers to avoid collisions with satellites launched by Elon Musk’s Starlink broadband internet project.

The space economy is being spurred on by insatiable terrestrial demand for data in an increasingly virtual 5G-enabled and cloud-based world. The proliferation of broadband internet-enabled satellites is driving down the cost of data just as demand for mobility solutions explodes. Simply stated, the more satellites are launched, the more the Earth-based market for data and data use can expand.

In its January report, NSR says the global space economy, both public and private sectors, is transitioning from hardware to application-based solutions. “Software-ification of the satellite and space markets is here,” report co-author Brad Grady comments. “In nearly all markets, the shift from hardware-centric thinking to software-enabled agility is unlocking new revenues.”

New markets are forcing established companies to reassess how they can engage in the space economy. Japanese carmaker Honda, for example plans to enter the small satellite launch business by 2030 using its experience with fuel-cell, combustion and control technologies in making gas turbine hybrid and self-driving cars. The company will develop a small rocket capable of carrying satellites weighing less than a ton and produced a prototype engine in just about two years.

Honda’s move is evidence the automotive sector’s track record of developing internal combustion engine (ICE) technology and lowering manufacturing costs could see it challenge incumbents such as SpaceX and Rocket Lab. Deploying ICE technology by entering the space business is also another way to offset declining margins as global auto markets transition to electric vehicles. But SpaceX’s technological milestone of deploying an orbital-class reusable rocket sets it apart from current competition.

Technology solutions led by the private sector coincide with the commercialization of major government programs such as NASA’s Artemis and commercial crew programs for the International Space Station. Artemis is a US led project to return humans to the moon by 2025. At the end of February, NASA agreed to a contract with SpaceX for three additional missions to the International Space Station, reportedly worth up to $900 million.

Meanwhile, increasing interest in parabolic flights such as suborbital missions are also likely to produce new revenue streams. Parabolic flights provide a near weightless environment for training and research. Space tourism and travel is also projected to see strong growth. More than 57,000 passengers are forecast to head into space through the decade, potentially generating more than $20 billion in revenues, according to NSR.

Money is flowing into the space economy, much of it through the recently popular vehicle known as a special purpose acquisition company (SPAC). These exchange-listed shell companies offer a ready-to-go structure that circumvents the due diligence and regulatory demands of an initial public offering, and they can be particularly appealing to companies with unproven technologies.

“Entrepreneurs want to strike when the iron is hot, and SPACs often allow them to do this,” says Armand Musey, president and founder of Summit Ridge Group, a consultancy focusing on the telecommunications, media and satellite industries. “Falling costs of satellite manufacture and launch enables entrepreneurs to develop compelling-sounding narratives about how things are different now, compared to the bankruptcies during the TMT [technology, media and telecom] bubble around the turn of the century.”

In January, Satellogic, a company specializing in high-resolution satellite data collection, merged with CF Acquisition Corp. V, a SPAC backed by Cantor Fitzgerald. “The SPAC structure allowed Satellogic to access the public markets and quickly, accelerating our ability to scale,” says Matthew Tirman, president of Satellogic North America. Satellogic received more than $265 million from the transaction.

Amid recent market turmoil, it remains to be seen whether the corporate sector, which invested around $13.9 billion into space-related projects last year, can meet the challenge from venture capitalists, who pumped $17.1 billion into 328 space companies in 2021, accounting for 3% of total global VC flows, says Space Investment Quarterly.

Risk appetite is the key driver transitioning the market from public/private to private/public models. The question is whether the new model is sustainable. The outcome is important to the future of the space economy, “Today, government agencies depend on the private sector to invest in program costs,” says John Wensveen, chief innovation officer at Nova Southeastern University (NSU) and executive director at the Alan B. Levan/NSU Broward Center of Innovation. “All trends indicate the future of space will be increased reliance on the private sector to develop new technologies, financially support government agencies and spearhead innovative initiatives.” At the moment, US equity continues to out-invest China by a substantial margin; while Singapore, the UK and India increased investments last year.

Regulating Space

Without government intervention, the private sector will commercialize space for private interests, without regard for benefits to humanity. In 2019, the US space economy accounted for $125.9 billion of real GDP, or 0.6% of US GDP, and 354,000 private sector jobs, according to the US Bureau of Economic Analysis.

Still, SpaceX’s recent brush with Chinese authorities, angered when two of the private company’s satellites came within four kilometers of the Chinese space station, highlights the challenge. SpaceX has approval to launch 12,000 Starlink broadband spacecraft, according to Space.com, adding to the collection of metal cruising above the atmosphere—and has applied to regulators for 30,000 more. Surmounting problems of radio interference is another area requiring a coordinated international response, says Musey.

An even bigger issue is the growing quantity of space trash. “Noncontrollable broken satellites and small pieces of space junk are a much larger danger [than satellites currently in use],” Musey says. “They cannot maneuver, and all other satellite operators must maneuver around them.”

The problem is becoming critical—particularly for low-Earth-orbit, the preferred location of broadband internet satellites, where real estate is finite. As one bit of space junk crashes into another it breaks into more pieces, which then cause more collisions, in a potentially cascading effect called Kessler Syndrome that could eventually take out everything.

The Inter-Agency Space Debris Coordination Committee, an independent organization comprising the space agencies of 12 countries and the EU, issued a set of guidelines in 2002, which have been updated several times since—but the committee lacks any enforcement authority.

“There needs to be a global consensus on regulations and how they are enforced,” says Aravind Ravichandran, director of strategy for space at tomorrow.io, a weather and climate security platform. “Absence of that may limit the sector’s attraction.”

Just like the aviation industry, the space sector is difficult to regulate at an international level because of the sheer number of countries involved. There is no global aviation body, although the International Civil Aviation Organization (ICAO) is a UN agency close to being a global regulator. Could it be a model for space regulation? NSU’s Wensveen says current international space law is outdated but the ICAO model might be a template to reboot the UN’s Office for Outer Space Affairs (UNOOSA) or even the basis of a new agency.

The International Space Exploration Coordination Group is currently the organization addressing space regulation, with 26 member agencies representing their countries and the EU. Still, any new agency would not be responsible just for safeguarding the space economy. Concerns over existential menace are rapidly rising up the space agenda. “Emerging technologies are leading to new threats in space, particularly associated with potential military acts that threaten life on Earth[; but] such an agency will be resisted by specific countries, with China being one example,” Wensveen adds.

According to UNOOSA, 1,807 satellites were launched last year, a 41.8% increase over 2020. In total there are 8,570 objects in orbit at this date, out of a total of 12,554 launched. At the end of December, the US accounted for 61% of operational satellites, China 10% and Russia 3%. Commercial satellites account for 85% of the US share, and military and government 14%, the Union of Concerned Scientists estimates.

The involvement of the private sector in the space economy—to date, largely in relatively benign efforts—might soon go deeper into the military side of the market. February’s launch by SpaceX of a classified spy satellite for the US military may be a harbinger of things to come. The nexus between government and the private sector is only going to get closer, particularly in the next wave of development, focused on services and propulsion, says Wensveen. SpaceX’s ability to maximize efficiencies clearly has gotten public sector interest. It uniquely reuses Falcon 9 first stages to reduce launch costs and boost productivity. Wensveen adds that the hitherto pure-play commercial basis of the space economy could change as nation-states pursue defense objectives. Such a development could test the private sector’s commitments and allegiances. “There is concern over the use of space transitioning to a military focus,” Wensveen says, and thereby “creating new opportunities for the private sector to directly and indirectly support countries.”

Despite turbulent financial markets, the space economy’s future looks all but assured. While military applications may grow, there is plenty of nonmilitary work to do. The Covid-19 pandemic accelerated a range of digitalization efforts and expanded the use of information to meet consumer desires, and these trends show no signs of stopping.

[ad_2]

Source