Table of Contents:

- Short Introduction to the company

- Analysis

- Ratio Analysis & Discounted Cashflow

- Outlook

1. Introduction

Sea Limited is a leading global consumer internet company founded in Singapore. Their mission is to better the lives of consumers and small businesses with technology. They operate three core businesses across digital entertainment, e-commerce, as well as digital payments and financial services, known as Garena, Shopee, and SeaMoney, respectively. Garena is a leading global online games developer and publisher. Shopee is the largest pan-regional e-commerce platform in Southeast Asia and Taiwan. SeaMoney is a leading digital payments and financial services provider in Southeast Asia.

1.1 Garena

Established in 2009, Garena is a leading online games developer and publisher with a global footprint across more than 130 markets.

Garena is the developer and publisher of Free Fire, a popular mobile battle royale game. In 2019, Free Fire was the most downloaded mobile game globally and the highest grossing mobile game in Latin America and in Southeast Asia*.

1.2 Shopee

Launched in 2015, Shopee is the leading e-commerce platform in Southeast Asia and Taiwan.

Shopee provides consumers an easy, secure, fast, and enjoyable online shopping experience that is enjoyed by tens of millions of consumers daily. It offers a wide product assortment, supported by integrated payments and seamless fulfilment. Shopee commits to helping brands and sellers succeed in e-commerce, and is highly tailored for each market in which it operates.

1.3 SeaMoney

Established in 2014, SeaMoney is a leading digital payments and financial services provider in Southeast Asia. SeaMoney’s mission is to better the lives of individuals and businesses in our region with financial services through technology.

SeaMoney’s offerings include mobile wallet services, payment processing, credit, and related digital financial services and products. These services and products are offered under AirPay, ShopeePay, SPayLater, and other brands in the region.

- Shopee is consistently ranked the top app in the Shopping category in Southeast Asia in terms of downloads, monthly active users, and total time in app on Android*.

- At the annual Esports Awards 2020, Free Fire received the inaugural Esports Mobile Game of the Year award.

- Garena’s largest global esports tournament of 2019, the Free Fire World Series, achieved over 130 million cumulative online views.

* Across the Google Play and iOS App Stores combined, according to App Annie. Southeast Asia rankings are based on Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam. Latin America rankings are based on Argentina, Brazil, Chile, Colombia, Mexico, and Uruguay.

2. Analysis

Sea Ltd. combines three megatrends:

- E-Commerce (Shopee)

- Gaming (Garena)

- Mobile Payments (SeaMoney)

Accordingly, the price has risen close to 400% in 2020. One might wonder: are these returns justifiable when compared with the business fundamentals? Let´s find out.

Third Quarter 2020 (ending September 2020) Highlights:

On a consolidated Group basis:

- Total GAAP revenue was US$ 1.2 billion, up 98.7% year-on-year.

- Total gross profit was US$ 407.6 million, up 100.6% year-on-year.

- Total adjusted EBITDA was US$ 120.4 million compared to negative US$ 30.8 million for the third quarter of 2019

For a company growing revenue and profit triple digits, this return is definitely justifiable.

Now to the financials per segment:

Digital Entertainment:

- Bookings were US$944.7 million, up 109.5% year-on-year.

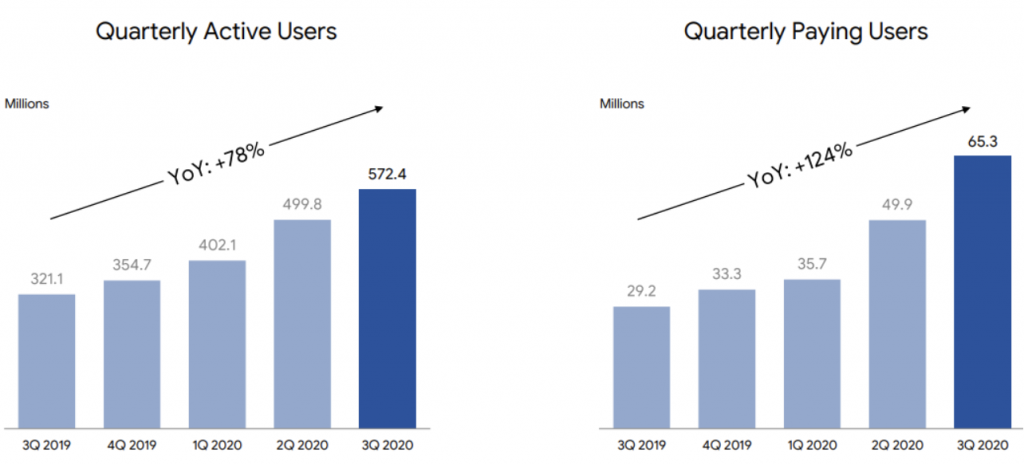

- Quarterly active users (“QAUs”) reached 572.4 million, an increase of 78.3% year-on-year

- Quarterly paying users grew by 123.6% year-on-year to 65.3 million, which

- represented 11.4% of QAUs for the third quarter compared to 9.1% for the same period in 2019.

- Average bookings per user were US$1.7, compared to US$1.4 for the third quarter of 2019.

E-Commerce:

- Gross orders totaled 741.6 million, an increase of 130.7% year-on-year.

- Gross merchandise value (“GMV”) was US$9.3 billion, an increase of 102.7% year-on-year.

- In Indonesia, where Shopee is the largest e-commerce platform, it registered over 310 million orders for the market in the third quarter, or a daily average of around 3.4 million orders, an increase of over 124% year-on-year.

- Both in Southeast Asia and in Taiwan, Shopee ranked number one in the Shopping category by downloads, average monthly active users, and total time spent in app on Android, for the third quarter, according to App Annie.

- Shopee was also the second most downloaded app globally in the Shopping category in the third quarter, according to App Annie.

Digital Financial Services:

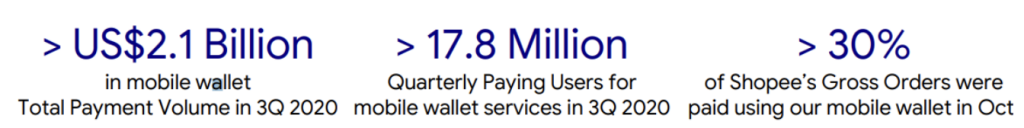

In the third quarter, SeaMoney continued to see strong growth in adoption of. The mobile wallet total payment volume for the quarter exceeded US$ 2.1 billion. Moreover, quarterly paying users for the mobile wallet services surpassed 17.8 million.

Integration of mobile wallet services with Shopee deepened further across Sea Ltd. markets, as more users recognized the clear benefit and convenience of using the mobile wallet services to pay. In October, more than 30% of Shopee’s total gross orders across their markets combined were paid using the mobile wallet. Sea Ltd. also continued to expand their suite of online and offline third-party use cases and partnerships in the third quarter.

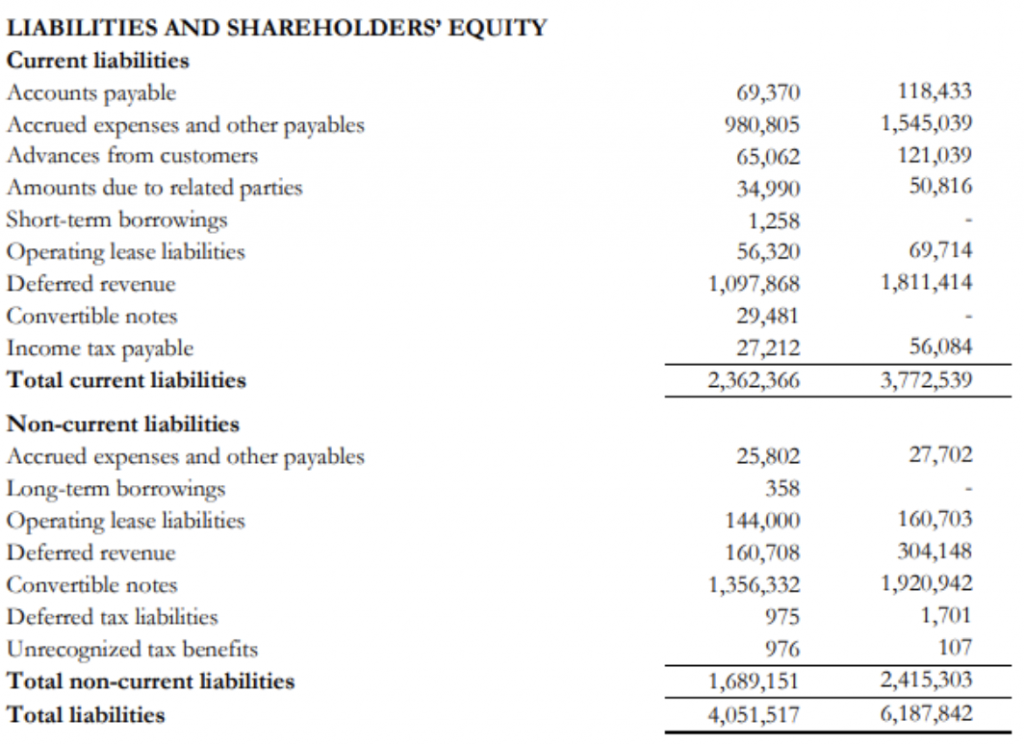

The balance sheet of Sea Ltd. is also looking really healthy with Cash and Cash equivalents of over US$ 3.5 billion, compared to basically no short-term debt and long term debt of under US$ 2 billion.

3. Ratio Analysis & Discounted Cashflow

As Sea Limited is not yet profitable, ratio analysis and valuation methods like DCF are not applicable and don’t make much sense, but nonetheless, some figures are:

(As of Sept. 30 2020)

Price/Sales ratio: 23.86

Price/Book ratio: 88.33

EV/Revenue: 27.98

Market Cap: US$ 75 billion

4. Outlook

Sea Limited raised the guidance for both digital entertainment and e-commerce for the full year of 2020.

In digital entertainment, they now expect the very strong performance in the third quarter to sustain through the fourth quarter. As a result, they expect bookings for digital entertainment to exceed US$ 3.1 billion, representing over 75.4% growth from 2019. The revised guidance represents an increase of more than 59.0% from the midpoint of the previously disclosed guidance of between US$ 1.9 billion and US$ 2.0 billion.

They also expect GAAP revenue plus sales incentives net-off for e-commerce

to exceed US$ 2.3 billion. The revised guidance represents a more than 144.1% increase from 2019, and a more than 31.4% increase from the midpoint of the previously disclosed guidance of between US$ 1.7 billion and US$ 1.8 billion

With a company growing pretty much every important metric triple digits and also being involved in three of the biggest growth markets (E-Commerce, Gaming and Mobile Payments) you can expect to pay a premium. Patient investors will be rewarded with an unseen return of a few hundred percent in the meantime.

This Stock-Report was created in cooperation with Coldxice. This report is not investment advice. It is only intended to introduce the company mentioned above.

Disclaimer

All information in this report is assumed to be accurate to the best of our ability. Tikenomics.com and Coldxice excludes all liability, to the maximum extent permitted by law, for any inaccuracies in the Content or for the consequences of your reliance on the Content. Investors should consider this report as only a single factor when making an investment decision.