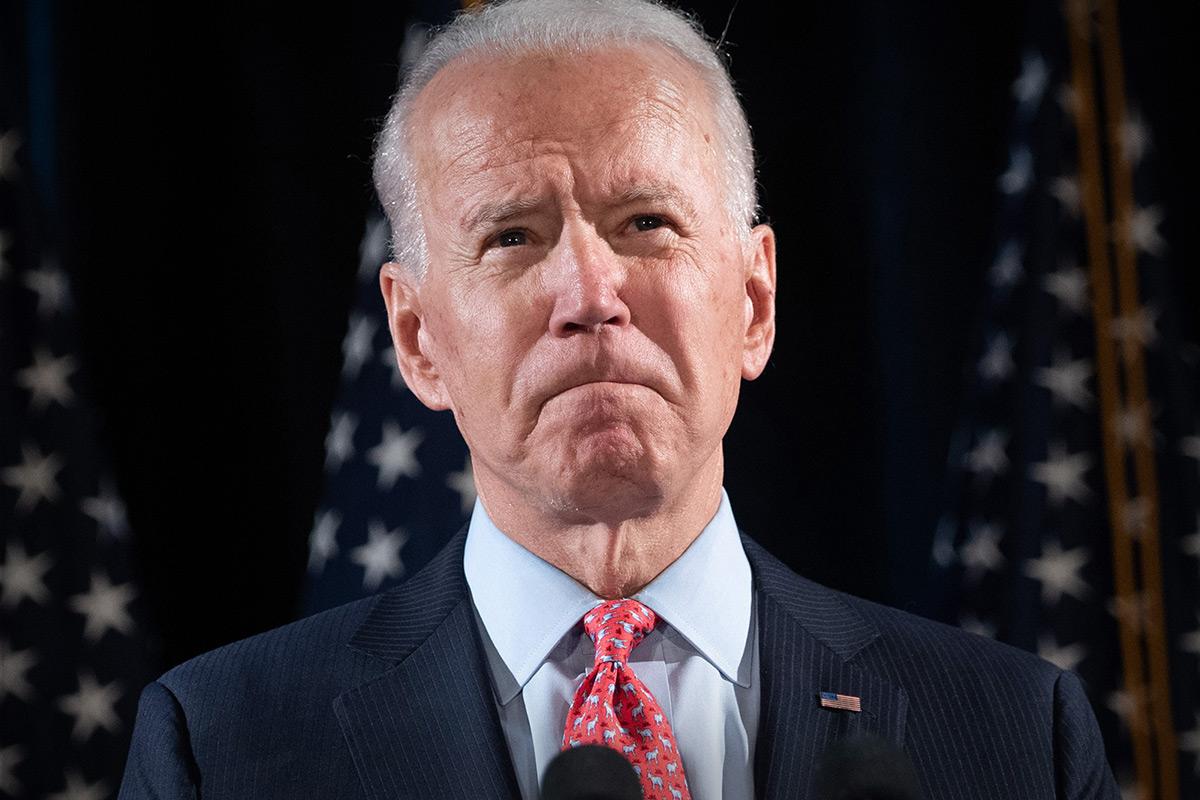

A new broom sweeps clean. Yep, a new president is upon us, and we need to be sure we have the right themes to ally ourselves with Joseph Biden.

Let’s get this straight: This administration is the most opposite a previous one since Abe Lincoln took over from James Buchanan. That means we have to turn the page on so much of what former President Donald Trump believed in, whether it be anti-immigration, pro-fossil fuels or vocally anti-China. That’s over.

We also have to believe that we are about to have some improvement in getting vaccines into peoples’s arms. I say that because I do not know how much worse we can do this. Putting the states in charge of the vaccine at the same time as putting the military in charge, putting McKesson Corp. (MCK) and putting CVS (CVS) and Walgreens (WBA) in charge, goes far to explaining the insanity of the current „process,“ although that word hints that there may be some organization to what’s going on. In many states, it has all come down to the county public health official doling the vaccine out and they don’t have the faintest idea how to do it.

I sincerely don’t think it can be worse. So score one for Biden, before he even starts, if he simply finds where the vials are hidden or lost given the tens of millions that have been made and not used.

Oh, and we will have the maker of a brand new kind of vaccine that might obliterate these new strains.

With that hopeful note, let’s get right to the „Investable Themes for 2021“ that I touched on last year with two new ones in keeping with what the president has outlined in the intervening weeks, particularly with the anointing of his cabinet.

First, e-commerce. I feel more strongly than ever that this theme is still in its infancy, as every retailer and restaurant chain has to adopt e-commerce. Winners: Target (TGT) , with Shipt, the same-day service and Chipotle (CMG) , with its ability to deliver products through many e-commerce windows, still makes sense, even up here. So does Shopify (SHOP) , or Etsy (ETSY) or Paypal (PYPL) or Square (SQ) . Oh, and, of course, FAANG. Facebook’s (FB) the best way to advertise, Amazon (AMZN) the No. 1 e-commerce play in the world, Apple (AAPL) , the essential e-commerce device, Netflix (NFLX) , the e-commerce entertainment king and Alphabet (GOOGL) , increasingly the rival of Amazon when it comes to buying, chiefly services.

Next, we are going to re-open, because we are going to have a national vaccine policy and it is going to change the nation’s fortunes. You want to participate, you want Marriott (MAR) , you want Airbnb (ABNB) , Southwest Air (LUV) and Boeing (BA) — more on the latter later.

Third, we are so early in the digitization of this country and the world that it is painful. Who wins in digitization: The two rivals Salesforce.com (CRM) and Microsoft (MSFT) . Of course Adobe (ADBE) . Service Now (NOW) . Workday (WDAY) . All the cloud-based companies.

Next up is cybersecurity. When you listen to these bank conference calls, you are struck by how much money they have to spend on cybersecurity. We have cloud native companies like Crowdstrike (CRWD) , or Z-scaler (ZS) and Okta (OKTA) , or we have companies that can do both, chiefly Palo Alto (PANW) . Frankly, I don’t care which you buy.

There’s a theme that’s been so overwhelming that it can’t be stopped. We ed that it can’t be stopped. We did a 5G basket the other day, T-Mobile (TMUS) , Crown Castle (CCI) , Marvell (MRVL) , Inseego (INSG) , Skyworks Solutions (SWKS) , Qualcomm (QCOM) and Taiwan Semiconductor (TSM) are the best ways to invest in it. What you must know, right here, right now, is that there is a tremendous shortage in chips right now. It is vital you own one.

Covid-19 stimulus is tougher. We just don’t have enough industrials to matter for infrastructure to be a play. I think that Martin Marietta Materials (MLM) can work or Vulcan Materials (VMC) . The individual stores that benefit? Walmart (WMT) , Amazon (again) Target (again) Costco (COST) , Home Depot (HD) , Lowe’s (LOW) , Dollar General (DG) , Dollar Tree (DLTR) , Whirlpool (WHR) , Stanley Black & Decker (SWK) are all in play.

We have heard endlessly that the Biden administration is going to continue the hardline President Trump had against China. I think that’s poppycock. The Democrats have lost their claim on helping the working person who has lost her job from the Chinese. I think that Biden goes back to the same old, same old: You buy our goods, we look the other way, except for Taiwan, which we know the PRC wants to take over. Who wins? Apple’s worries about China sales? I think they’re over. Nike (NKE) and Starbucks (SBUX) are in there, but good. Finally, Boeing. The Chinese need planes. Boeing, which directly and indirectly employs two million people, should be the biggest beneficiary of the Biden regime — if Biden doesn’t tweet and starts to negotiate.

Individual stock selection and wealth management are the denizens of Morgan Stanley (MS) and Goldman Sachs (GS) . Unbelievable quarters, capitalizing on the new era of people who know that stock picking is a treasure denied by people who come on air and hector and embarrass you.

Remote work is so here to stay that those who think that we are going back to the central office missed the last year when the productivity soared among the employed, because they stayed at home. Winners: Williams-Sonoma (WSM) , Wayfair (W) , Logitech (LOGI) , and Zoom (ZM) . Oh, and, of course, Amazon. We’re not done with this theme.

Health care will be huge, because I think this administration will embrace the process of more democratic, not nationalized, but democratic health care. That means good news for Centene (CNC) , for Aetna now CVS and Humana (HUM) . I like breakthrough drug makers such as Eli Lilly And Co. (LLY) for Alzheimer’s and Regeneron (REGN) for therapeutics. This president will embrace and encourage science, which was openly ridiculed by the previous administration, something that millions of people now believe.

And now I have two new themes that you have to be impaired by gin or perhaps vodka to be missing: First is environmental regulations that are going to drive electronic vehicles. We are seeing it all over the place, with a leader of Tesla (TSLA) . But so many companies fit it, like Plug Power (PLUG) for green hydrogen, or Northern Genesis (NGA) , soon to be Lion Electric, or any of the Lordstowns (RIDE) or CIIG (CIIC) , which will be merging with U.K.-based Arrival. Increasingly, though, I am being drawn to Ford (F) , because of its Rivian investment and the coming electrification of the F-150 and GM (GM) for all things EV. They are the cheapest ones. They have the momentum.

Finally, one more theme: housing. I had been reluctant to recommend Toll (TOL) , KB Home (KBH) , Pulte Group (PHM) , D. R. Horton (DHI) and Lennar (LEN) , because I feared higher rates. But the Fed chief and the new Treasury Secretary, Janet Yellen, took those off the table. I worried about tightness, but we have little more than two months, arguably the lowest ever. Finally, the coup de grace, Biden is openly pro-immigration. There are a minimum of 10 million people who can stop hiding and being worried about getting deported and can soon ask for credit to buy a home. It will be an amazing time to be a homebuilder.

Now, the administration does have the ability to shift things. You get infrastructure you go CAT (CAT) . You get push into solar, you still go Tesla (TSLA) but you can augment it with SunPower (SPWR) . But unlike these other themes, the jury’s out on those.

Now, remember what you do with themes. You fall back on them. You don’t chase these stocks. You have to bet on multiple setbacks, because the idea we are somehow now united after this inauguration is just a fairy tale and we know after the events of the last few weeks in the Capitol they don’t come true.

No matter, these don’t need a new president, an old president, or any president. They need capital and this stock market will give them all they want in abundance.

(F, SBUX, NKE, GS, MSFT, CRM, BA, GOOGL, FB, AMZN, AAPL, CVS, CCI, MRVL, WMT, and COST are holdings in Jim Cramer’s Action Alerts PLUS member club. Want to be alerted before Jim Cramer buys or sells these stocks? Learn more now.)

Get an email alert each time I write an article for Real Money. Click the „+Follow“ next to my byline to this article.

[ad_2]

Source