Russia has threatened to pay international bondholders in roubles rather than dollars just days before a key interest payment on its external debt comes due.

Anton Siluanov, Russia’s finance minister, said on Sunday that it was “absolutely fair” the country would make all of its sovereign debt payments in roubles until western sanctions that he claimed have frozen $300bn of the country’s reserves were lifted.

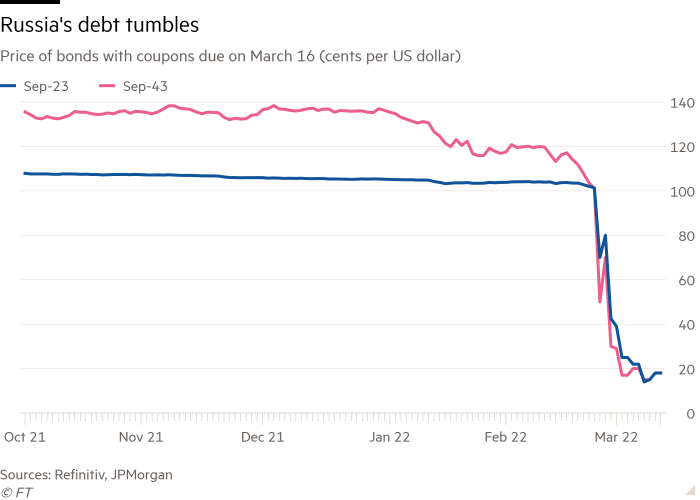

Moscow is scheduled to make a combined $117mn in interest payments this Wednesday on two dollar-denominated bonds, according to JPMorgan. Neither bond’s contracts gives Russia the option of paying in roubles, according to the Wall Street bank.

The latest warning to foreign bondholders ratchets up the chances the country will default on its debt for the first time since the Russian financial crisis in 1998, as its financial system comes under heavy strain from the measures western governments have taken following the invasion.

“We need to pay for critical imports. Food, medicine, a whole array of other vital goods,” Siluanov told a state television interviewer. “But the debts we need to pay to the countries that have been unfriendly to the Russian Federation and have limited our use of foreign currency reserves — we will pay off our debt to these countries in the rouble equivalent,” he said.

Siluanov said that almost half of Russia’s $643bn foreign reserves had been hit by the sanctions, but did not disclose the denominations and jurisdictions where Russia holds other currencies.

Investors have been bracing for a default, with both bonds trading at around 20 cents on the dollar. Moscow will have a 30-day grace period to make the coupon payments.

International investors hold around $170bn in Russian assets, according to Financial Times calculations, with foreign currency bonds accounting for $20bn. More than two dozen asset management companies have had to freeze funds with significant Russia exposure, while others have had to sharply write down their value.

There has been an exodus from Russian assets since the invasion, as the US and the EU have sought to sever the country’s ties to the global financial system. Moscow’s stock market has been closed since February 28, but shares in many Russian companies listed abroad have crumbled in value. The rouble is down more than 45 per cent this year, putting it on track for the biggest annual fall since 1998, when Russia defaulted on its local currency-denominated debt.

IMF managing director Kristalina Georgieva told US broadcaster CBS on Sunday that “in terms of servicing debt obligations, I can say that no longer we think of Russian default as improbable event”.

In a sign of how abruptly western investors’ view of Moscow has changed, Russia was rated investment grade at Fitch, S&P Global and Moody’s Investors Service — the three main rating agencies — up until February 25.

As of the start of February, Russia kept $311bn in foreign securities, $152bn in cash and deposits in foreign banks, $30bn in special deposit receipts at the IMF, and a further $132bn in gold. Russia has cut its dollar holdings from 45 per cent of the total share in 2013 — the year before the first western sanctions over the annexation of Crimea — to just 16.4 per cent in 2021.

The central bank publishes data on the structure of Russia’s foreign reserves with a lag of at least six months. As of June 2021, the euro made up 32.3 per cent of Russia’s holdings, the renminbi 13.1 per cent, the pound 6.5 per cent, other currencies 10 per cent, and gold 21.7 per cent.

China held 14.2 per cent of Russia’s reserves, the largest share of any country, with Japan holding 12.3 per cent and Germany 11.8 per cent.

Siluanov claimed western countries were pushing China to restrict Russia’s use of its renminbi reserves, but said he was confident Beijing would not bow to the pressure. “I think our partnership with China will allow us to maintain the co-operation we’ve achieved and increase it when western markets are closing,” he said.

[ad_2]

Source