CRISPR Therapeutics AG, a gene editing company, focuses on developing transformative gene-based medicines for serious human diseases. It develops its products using Clustered Regularly Interspaced Short Palindromic Repeats, a gene editing technology that allows for precise directed changes to genomic DNA. It has a portfolio of therapeutic programs in a range of disease areas, including hemoglobinopathies, oncology, regenerative medicine, and rare diseases. The company’s lead product candidate is CTXOO l, an ex vivo CRISPR gene-edited therapy for treating patients suffering from transfusion-dependent beta thalassemia or severe sickle cell disease. It is also developing CTXl 10, a donor-derived gene-edited allogeneic CAR-T therapy targeting cluster of differentiation 19 positive malignancies.

The company is also developing allogeneic CAR-T programs comprising CTX120 targeting B-cell maturation antigen for the treatment of multiple myeloma; and CTX130 for the treatment of solid tumors and hematologic malignancies. CRSP engages in developing regenerative medicine programs in diabetes; and in vivo and other genetic disease programs to treat glycogen storage disease Ia, Duchenne muscular dystrophy, and cystic fibrosis.

CRSP has laid out plans for research collaborations with Vertex on Duchenne muscular dystrophy, cystic fibrosis, and they have plans to address other diseases they are not yet making public.

CRSP has strategic partnerships with Bayer Healthcare LLC, Vertex Pharmaceuticals Incorporated, and ViaCyte, Inc. CRISPR Therapeutics AG is headquartered in Zug, Switzerland.

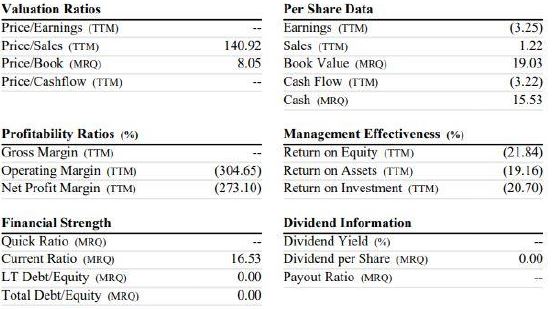

Business Finances

CRISPR Therapeutics has had a fantastic 2020, more than doubling in value. This biotech company uses gene therapy to remedy genetic mutations with the overarching goal of treating and curing diseases, diabetes, cancer, and hemoglobinopathies.

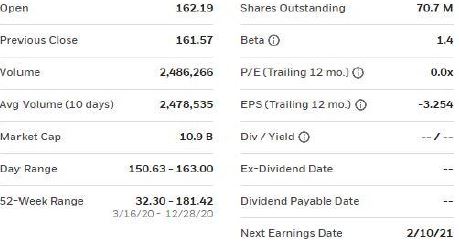

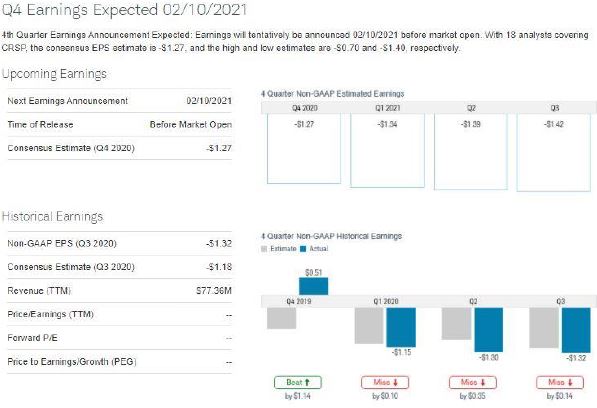

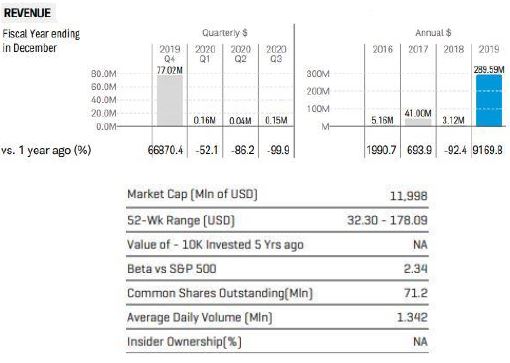

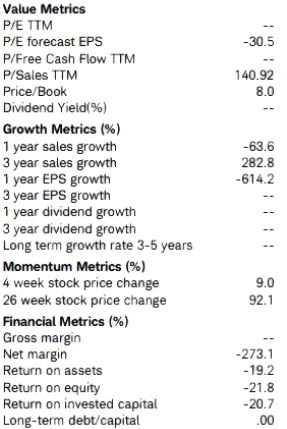

The 3rd quarterly report, released on Monday, November 2nd, showed the company achieved $1.32 earnings per share for the quarter, which missed most wall street analysts estimates of CRSP had revenue of $0.15 million during the quarter, compared to the consensus estimate of $2.22 million. CRISPR Therapeutics had a negative return on equity of 20.72% and a negative net margin of 273.10%. The business‘ s revenue was down 99.9% compared to the same quarter last year. During the same period in the previous year, the firm earned $2.40 EPS.

CRSP has reported full-year sales of $4.81 million for the current fiscal year, with estimates ranging from $350,000.00 to $18.10 million. For the next year, analysts anticipate that the business will report sales of $32.63 million, with estimates ranging from $600,000.00 to $90.00 million.

These numbers from 3rd quarter may have missed the mark, but investors are still extremely confident in the underlying fundamentals of the company and are hopeful for the projects in the company’s pipeline. CSRP shares have skyrocketed over the past 12-months, coming from a low of $32.30 in early March, to a record high of $181.42 at the end of December 2020. This record high was achieved after the company announced that CRISPR / Cas (gene-editing therapy candidate) CTXOO l , has demonstrated a consistent and sustained response to treat ment in patients with transfusion -dependent beta thalassemia as well as patients with sickle cell disease

Important note: Crispr Therapeutics AG is set to release earnings on 2 /10 / 2021. During their last earnings release the company posted EPS of $-3.25.

Technical Analysis: CRISPR Therapeutics AG (CRSP)

CRSP appears to be correcting within a longer-term bullish trend. MACD is presently below the signal line, shares remain 77.0% above an upwards sloping 200-day moving average. Comparative Relative Strength analysis shows that this issue is outperforming the S&P 500. The 14-period Slow Stochastic Oscillator is falling, as investors sell shares and drive the price lower causing a strongly bearish momentum. The On Balance Volume indicator is bullish. The slope of the indicator is positive and suggests that buyers are presently more active than sellers. The Bollinger Bands are presently wider than usual, as a result of greater than normal volatility that accompanied the recent price move. Events such as this may precede a pause or reversal in the near- term trend.

The stock has outperformed the market over the last 50 trading days when compared to the S&P 500. Over the last 50 trading sessions, there has been more volume on up days than on down days, indicating that CRSP is under accumulation, which is a bullish condition. The stock is trading above a rising 50-day moving average. This validates the strong technical condition for CRSP. The stock is above its 200-day moving average which is pointed up indicating that the intermediate term trend is bullish.

Buy or Sell: CRISPR Therapeutics AG (CRSP)

One of the key areas wall street investors are examining for CRSP is the outcome of CTXOO l, an experimental therapy for two hemoglobin-based disorders: beta-thalassemia and sickle cell disease. CRISPR Therapeutics is developing it in partnership with Vertex Pharmaceuticals. This single-application treatment involves reengineering a patient’s own stem cells to produce fetal hemoglobin once they’ve been reinfused, and it appears to work as intended. If successful CTXOO l and other experimental cancer treatments by CRSP, could rapidly drive the stock up. However, CRSP will face stiff competitions from bluebird bio, and considering the usual issues that clinical-stage biotech’s must navigate, the company faces significant risks.

In December, the company announced promising results of CRISPR / Cas (gene- editing therapy candidate) CTXO O l. CRSP presented the new data at the annual meeting of the American Society of Hematology. Meanwhile, the data was also published in the New England Journal of Medicine. This pushed the stock to a 12- month high of $181.

Investors are very aware that gene editing has the potential to alter the treatment of chronic conditions dramatically. Investors are advised to continue paying close attention to CRSP’s pipeline. If it turns out the company’s innovative treatment prove safe and efficacious, there will be much more money to be made through partnering and licensing.

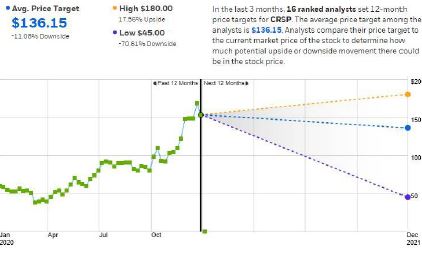

CRSP is currently priced around $30 below its 52-week high, sitting at $153.11. The stock’s 52-week low is a mere $32.30.Analysts have set an average price target of $136.15, indicating a potential 11% downside.

CRSP has minimal debt, along with nearly $1.5 billion in cash, given even more reason to feel bullish about CRSP’s future. If you are a patient investor willing to wait upwards of several years for a potentially large return, you could consider adding CRSP to your portfolio today. If you are looking for an immediate return, investor would examine CRSP bouncing back to the 52-week high for a quick return on investment.

Entry and Exit Positions: CRISPR Therapeutics AG (CRSP)

As indicated above, we believe this could be an ideal long-term asset to an investor’s portfolio. The fundamentals remain strong in the company and the promising product line could prove very successful for the firm. If you are a long-term investor, selecting the correct entry and exit point would be dictated by the individual investor. An investor could wait for the stock to have a slight pull back from the current high, or an investor could jump into it now, paying the extra premium. Either case, we believe over the coming years CRSP will be a reliable stock to your portfolio.

If you are looking for a quick, short return of investment we recommend following our entry and exit resistance lines.

Entry: Above, we have provided one blue resistance line at approximately $146. This resistance line is the average stock price during the month of December. Before the next earnings report (2110 / 2021) we don’t believe this stock should be trading below this line. If the stock drops below this line, an investor could enter at this price point. As of early January, early predictions and analyses shows there are no reason to show that the next earning report will not be positive. If the company continues to announce promising results of there CTXOO 1treatment, a large, swift uptick could occur.

Exit: Above, we have provided one red resistance line at approximately $181. This resistance line is the 52-week high achieved in late December. A strong 2020 performance and positive news has pushed the stock to this 52-week high. If the stock is approaching this level and you entered at $146, we believe this 20% return of investment is a reliable solid investment and to exit the trade. Investors can choose to either lock in this 20% return on investment or wait to see how high the stock will rise, but we are confident the stock will not soar past this level.